| Gaming and Entertainment View the Forum Registry XML Get RSS Feed for this thread | Self-edit this thread |

|

| 0 |

Subject: 401K Early Withdrawl Posted by: Great One - [56438112] Mon, May 12, 2008, 11:23 So there is pretty much no way to tap a 401K to use for a down payment on a house without penalty? Anyone had experience just taking the tax hit and using the money? Seems like its probably not worth it. On the other hand its a pretty good time to buy a house so perhaps some of that money taxed as income could pay itself back as house prices go back up the next few years. My employer does offer loans from 401K but that doesn't really help pull my monthly payments down cause I'm still paying back more - just to two different places. I'm looking to buy something under the 250,000 range in the next year. Ideally, I'd want to put down 20% (50,000), correct? I've never bought a house, so help me out folks! any real estate guys or mortgage brokers out there? we can turn this into "Help GO Buy a House Fantasy Challenge!" :) | |||||||

| 1 | Great One ID: 56438112 Mon, May 12, 2008, 11:24 |

401k Hardship Withdrawal What if your employer doesn’t offer 401k loans or you are not eligible? It may still be possible for you to access cash if the following four conditions are met (note that the government does not require employers to provide 401k hardship withdrawals, so you must check with your plan administrator): The withdrawal is necessary due to an immediate and severe financial need The withdrawal is necessary to satisfy that need (i.e., you can’t get the money elsewhere) The amount of the loan does not exceed the amount of the need You have already obtained all distributable or non-taxable loans available under your 401k plan If these conditions are met, the funds can be withdrawn and used for one of the following five purposes: A primary home purchase Higher education tuition, room and board and fees for the next twelve months for you, your spouse, your dependents or children (even if they are no longer dependent upon you) To prevent eviction from your home or foreclosure on your primary residence Severe financial hardship Tax-deductible medical expenses that are not reimbursed for you, your spouse or your dependents All 401k hardship withdrawals are subject to taxes and the ten-percent penalty. This means that a $10,000 withdrawal can result in not only significantly less cash in your pocket (possibly as little as $6,500 or $7,500), but causes you to forgo forever the tax-deferred growth that could have been generated by those assets. 401k hardship withdrawal proceeds cannot be returned to the account once the disbursement has been made. | ||||||

| 2 | Perm Dude ID: 394501120 Mon, May 12, 2008, 11:28 |

Yeah, you're going to get hit with a penalty if you withdraw from a 401K, even with cause. If you can save up the money in the next year, you will be far ahead of the game. See if you can put it into a money market account (might as well get a little interest in the meantime), even if you are only able to make small deposits. In the meantime, get yourself a copy of your credit report and make sure everything is kosher. Sometimes errors creep into those things and you need to give yourself time to correct any errors before your eventual mortgage company looks at it. What area are you looking to buy into? pd | ||||||

| 3 | Great One ID: 56438112 Mon, May 12, 2008, 11:28 |

FYI - by this time next year, I'd comfortably have 10-15k for a down payment and could easily double that with withdrawl's so I am trying to determine if thats the right route. I read somewhere that the 20% threshold was important to avoid an extra insurance fee? But I don't see me getting up to that number by next year. And living here (Central NJ, we both work in Princeton, want to live on outskirts i.e. Hamilton, Plainsboro, South Brunswick, Monroe) there isn't too much under 200K -- even condo's and townhouses which are probably the target for this first place. | ||||||

| 4 | Great One ID: 56438112 Mon, May 12, 2008, 11:29 | I've been working the credit report for a couple years now and made some great strides from the disaster it was after college. My mother has also agreed to co-sign and has excellent credit so thats gonna be useful I'd imagine. | ||||||

| 5 | Great One ID: 56438112 Mon, May 12, 2008, 11:31 |

I've also been trying to find a site that has a list of all the taxes by town - like Town X is X% taxes vs. Town Y is X%. Then I could cross off the highest couple towns and not bother to look there. | ||||||

| 6 | Species Dude ID: 07724916 Mon, May 12, 2008, 11:42 |

GO - I'm not a residential mortgage guy but as you know I am a banker so I know a little. First off, yes, if you can you definitely want to put 20% down. The fee you refer to is called "Mortgage Insurance", referred to mainly as "PMI" - I'm not sure what the P stands for (Primary? Personal?). It's insurance to the lender for the amount of their loan above the standard 80% mortgage. In today's environment after the "sub prime mortgage" crisis, my guess is that all of the generous aspects of 80+% mortgages have gone out the window, so PMI is an even greater burden than it was 3 or 4 years ago. I actually did cash out a part of my 401k once to help a family member and took the (off the top of my head) 40% hit. The down payment on a new primary residence angle is something to look further into. Your mortgage lender might have consultants that have the definitive advice on that. While true it sucks to dip into that and lose the continued appreciation for retirement, if it means you get into that first home without PMI, I'd probably suggest going for it. You have another 35+ years to save up...but the longer you wait to buy that first home, you lose out on that appreciation as well. My recommendation is to go get "pre qualified" with your lender of choice about 30-60 days before you are serious about buying. You will get more respect from the seller and their agent if you have done that. | ||||||

| 7 | biliruben ID: 33258140 Mon, May 12, 2008, 16:39 |

This is a terrible time to buy a house. Wait and save up a down payment; you'll be happy you did in the long-run. Prices will continue to fall at least through 2009, is my guess. Probably 2012, then flat for 80-100 years. Maybe 200. ;) Of course I'm looking to buy within the next year, so do as I say, not as I do. I have my down payment already, however. Where do you live? | ||||||

| 8 | biliruben ID: 33258140 Mon, May 12, 2008, 16:40 |

I cashed out my 401K to go back to school and took a penalty. I look back on it now as a big mistake. It was only like 5K, but I missed out on the biggest stock run up in my lifetime. Again, do as I say not as I do! | ||||||

| 9 | Frick ID: 23117516 Mon, May 12, 2008, 16:59 |

Before the credit crunch it was fairly easy to get 80-20 loans. The primary loan was for 80% of the homes value (and thus avoided PMI) and a secondary loan for 20%. Normally the 20% loan would be for a shorter time period 10-15 years with a balloon payment at the end. I don't know if those types of programs still exist, if you can save 10 or 15% of the down payment you might be able to get a 80% loan and a second loan for 5-10%, that depends on the on going credit situation and your credit score. I'll second others when I say cashing out a 401k is a bad idea. Not only does it depend on your employer, if they don't allow it, there isn't much you can do, but the penalties are steep. It also will effect your net income for that years taxes, and could put you in a higher tax bracket. | ||||||

| 10 | The Beezer Dude ID: 191202817 Mon, May 12, 2008, 20:55 |

I gotta agree with bili - buying at this point just isn't a good idea. Looking at numbers from New Jersey Real Estate Report, there is currently around a 17-month supply of homes on the market (greater than 6 months is considered to not be a seller's marker), and prices are dropping rapidly. It sounds like you've got the right idea with saving and getting your credit improved. Then, when prices and inventory have stabilized, you'll be all set to buy something affordable. As long as you don't expect to make money from living in a house, you should be fine. | ||||||

| 11 | tastethewaste ID: 911431318 Mon, May 12, 2008, 21:47 |

ive never heard of a hardship withdrawal from your 401K being for the purchase of a home, only to prevent foreclosure or eviction. In any event you wont be able to take the hardship without exhausting the loan option first. If you have an IRA, you can pull out 10K if you are using it for the purchase of a home for the first time and avoid the 10% penalty. So if you have any old 401Ks, roll it to an IRA and then take it out for the purchase of a home. or See if you have any non hardship money in your 401K that is eligible to be rolled without meeting a distributible event (i.e. termination of employment, age 59.5) and roll it into an IRA and withdraw from the IRA to avoid the 10% penalty or Look into the loan closer. You may be paying the loan at an interest rate but you may be paying yourself back the interest. This works a lot better than paying a bank. The only problem is that you pay taxes on the interest twice. Since the loan payments are after tax payments you are paying taxes and then once you withdraw the money from your 401K at retirement you will pay tax again. Interest rates on 401K loans should be around 6% currently. | ||||||

| 12 | tastethewaste ID: 911431318 Mon, May 12, 2008, 21:49 | also if you do decide on the hardship (if allowable) you cant contribute to your 401K for 6 months. Hardships really are last resorts and really its not logical to do this. | ||||||

| 13 | Perm Dude ID: 394501120 Mon, May 12, 2008, 22:25 |

Actually, I think this is a buyer's market right now. Inventory is pretty much at an all-time high in NJ, people are awfully motivated to sell, and the burnthrough in the mortgage field means a lot less hanky-panky on loan arrangements. If you qualify, you're likely to be getting a pretty solid financial vehicle. If you have the money and want to hold, by all means look around. Waiting for the market to heat up again, as a buyer, is not wise IMO. | ||||||

| 14 | ChicagoTRS ID: 344311322 Mon, May 12, 2008, 23:01 | If you have the cash and do not need to sell a home this is a great time to buy...a lot of bargains on the market and a real possibility to low ball someone that needs to sell. | ||||||

| 15 | rockafellerskank Dude ID: 27652109 Mon, May 12, 2008, 23:21 |

Your interest tax deduction will offset some of you IRS penalty cost for raiding the 401k. I'd go the 41k-loan route, but, be prepared to pay off that loan over the next 12-24 months. And, dont take more than you need to get to 80% LTV. Now, you might get to 80% LTV easier than you think by playing hardball. I still think buying now is better than renting AS LONG AS you take advantage of the current situation. Go get pre-qualified, then negotiate the heck out of the deal. Don't fall in love with a "home", be prepared to offer low-ball and walk if you don't get your terms. If you can by below now for the eventual property low value, you will be way ahead.. even with the 401k penalties. Try to buy that $250 house for $185k'ish. Even if you end up at 200k value in 3 years, you're fine and you didnt pay rent and you got tax benefits. | ||||||

| 16 | Great One ID: 56438112 Tue, May 13, 2008, 09:31 |

Yeah everything I had read said it was a great time to buy (as long as you didn't need to sell another place first, cause that would negate the advantage). But going from rent-->buy right now as ideal. I think targeting a place closer to 200K would give me a more legit shot of coming up with the 20% which seems like its pretty important. I just wish I could find a little house for like 150K then I'd move in this summer! haha... after living in SC and seeing the house prices around there, its so tough to swallow spending what you have to for something comprable in NJ. I need to get out of here. Google did just open an office down in Charleston! :) I did read something about the tax year after buying a house, you get a some money back. Anyone know what I'm talking about? I didn't really understand that one. But if that were the case, perhaps it would offset some of the tax losses incurred by an early withdrawl. We're also getting married next May (shooting to buy the house/condo a couple months after wedding) so I wonder how that would impact taxes. | ||||||

| 17 | ChicagoTRS ID: 4110481415 Tue, May 13, 2008, 09:58 |

You do not necessarily need 20% down...it just means you will pay PMI...which will be around ~$50 per month per 100K you borrow...and you only pay that until you have 20% equity. Personally I think it is a better idea to pay PMI than rape your 401K...not only will you pay penalties/taxes but you are hurting your future retirement. This "early" money in your 401K is the money that will really grow exponentially over the life of your account (hopefully). Not sure on the tax thing...your interest, property taxes are deductible and typically would be more than your standard deduction so you will be itemizing...and likely getting more tax dollars returned. | ||||||

| 18 | Great One ID: 56438112 Tue, May 13, 2008, 10:51 |

So on the 200K house, its roughly $100 extra per month insurance charge until we actually hit that 20% threshold. Alright that makes sense. So even if I only got up to like 16% down payment - I could quit paying the PMI after a few years. That doesn't seem so bad. Maybe take two consectutive years of bonuses and tax returns and put it into extra payments to push it across that threshold as soon as possible. Thanks for everyone's help - keep it coming! | ||||||

| 19 | biliruben ID: 4911361723 Tue, May 13, 2008, 11:51 |

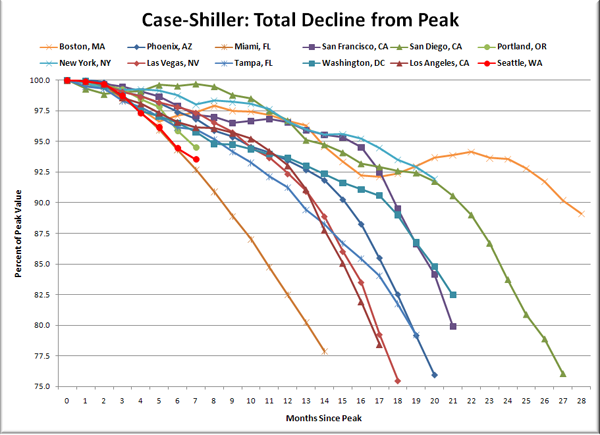

I hear it's sometimes hard to get PMI removed. The house has to appraise 20% above your mortgage. If property values continue to plummet, you'll be chasing the 20% line down. You appear to be reading the wrong websites, GO, if you think it's a great time to buy. Ignore everything from the any Real Estate Professional. They are blatantly biased. Here's a nice graph you should consider:  Does that look like a good time to buy to you? The expression is catching a falling knife, I think. | ||||||

| 20 | Perm Dude ID: 35455139 Tue, May 13, 2008, 12:20 |

That's true overall, but lacks local and user context, bili. The only falling (or rising) values graph that matters is the Central NJ area where GO is looking to buy (and, even if you look at the entire NYC regional area on your graph, you'll see that its drop is not as sharp, even including the falling-off-the-table Manhattan values). Since he is not selling a home but looking at a long term hold in a large inventory area, this is practically the definition of a buyer's market. Eventually (and at different times) the market will bottom. Waiting until it starts rising again is when it becomes a seller's market--too late for the best deals. Finally, GO is looking to buy sometime in the next year. There is a very good chance that good research will help GO find the right mortgage even in this market, particularly if he's not buying in Miami, Los Vegas, Detroit, or any of the other areas which have seen values drop by amazing amounts. I absolutely agree with being very careful about what any real estate professional says. Independent research is needed more than ever. | ||||||

| 21 | biliruben ID: 4911361723 Tue, May 13, 2008, 12:36 |

I will let GO insert his local and user context. Like I said, I'm buying in the next year as well, so I understand that. What I disagree with is that this is a great time to buy. Yes, by the NAR definition it's a "buyer's market", meaning there's record inventory and few sales. That does not mean it's a good time to buy. Obviously you want to buy as close to the bottom as possible, and be in the best financial situation to negotiate a good price and a good mortgage. It sounds like GO doesn't have 20% to put down, which isn't the best financial situation. Add on top of that the very real probability that houses will continue to fall, perhaps very substantially if you believe Shiller or Krugman or any number of other economists and CEOs bandying about the possibility of 30% or more declines, or at least stay flat for many, many years into the future, and sitting for a year, watching the market and gathering that 20% seems like decent advice. He can obviously take it or leave it, but I just can't let "it's a great time to buy" malarkey get spewed without some comment. It ain't, unless you have a tremendous desire to quickly owe more than you own. | ||||||

| 22 | Perm Dude ID: 35455139 Tue, May 13, 2008, 12:42 |

My understanding is that GO is saving up for the 20% (maybe I misread him, above), which is why he's not buying right now. My own belief is that "the more down, the better" and if I were buying now I'd look for 30% down, but I'm in a market with a lot lower taxes (including that kick-in-the-pants real estate transfer tax). In fact, I left an area very close to GO because of high taxes (I was in Hunterdon County, NJ until about 4 years ago). I understand your wanting to provide some sobering detail as to the market, but my comment on it being a buyer's market wasn't boilerplate from a Realtor (r). The silver lining in all this is that first time buyers like GO will go into it with their eyes open, including not trusting the "professionals" in the market. A very good thing. | ||||||

| 23 | Great One ID: 56438112 Tue, May 13, 2008, 12:44 |

I guess part of the debate is that you have consider all the money I'm throwing out the window by continuing to rent. Though I am not smart enough to factor all that in terms of building equity (I pay 1,100 per month). So I am losing that every month for probably the next 12-15 months minimum... so if I continue to rent for another year on top of that while saving an extra 10,000 to get me over 20%, is it worth it? thats what I am trying to figure out. If BR thinks home values will continue to fall (I am specific to Central NJ) then that will help me meet that 20% even quicker so thats good news. The gap will be closing on both sides (me saving + the 20% target being a lower amount). | ||||||

| 24 | Great One ID: 56438112 Tue, May 13, 2008, 12:46 | I will be using a close friend of the family as a realtor and he has done pretty well for a few others we know, so I feel like I have an ally on that front. | ||||||

| 25 | Perm Dude ID: 35455139 Tue, May 13, 2008, 12:48 |

Just to back up bili's point, from the Press Release accompanying S&P's February Price Indices (pdf) “There is no sign of a bottom in the numbers,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor's. “Prices of single family homes continue to drop across the nation. All 20 metro areas were in the red for the February-over-January reading. In addition, 19 of the 20 MSAs are still reporting negative annual returns. The monthly data show that every one of the MSAs has now declined every month since September 2007, marking six consecutive months. On top of that, declines have remained steep with eight of the 20 MSAs and both composites reporting their single largest monthly decline in February.” | ||||||

| 26 | biliruben ID: 4911361723 Tue, May 13, 2008, 12:54 |

To be clear, I know nothing about central NJ. In the past, RE pricing trends have been a relatively local phenomenon. I think this time around, because of the global nature of the mortgage crisis, it isn't nearly as local as in the past. Sure, some places saw higher, highs and some will see lower lows, but there is an underlying national trend at work here as well. Good luck, GO. | ||||||

| 27 | Great One ID: 56438112 Tue, May 13, 2008, 12:55 |

Like I said above -- that would be good news for me... let them keep falling. I just need someone to go "now!" so I know when it hits rock bottom and I can make my move. Unfortunately, nobody really knows when that will happen. I feel bad for everyone trying to sell though. I guess if you don't plan to sell or move, it doesn't really matter... but it would suck being forced to move for a job or something right now. I know my Aunt is paying 2 mortgages right now for that very reason. That sucks. | ||||||

| 28 | Great One ID: 56438112 Tue, May 13, 2008, 12:57 | On a side note, imagine if you had like a million bucks saved and you could go in an buy like 7 condo's or houses at these low prices and then rent them out? That would be a hell of an investment. Gotta have money to make money as they say. | ||||||

| 29 | Boxman ID: 337352111 Tue, May 13, 2008, 13:18 |

Great One: Please don't follow thru on this. I want to give you friendly advice. There's only certain people on these forums that I'm admittedly rude to, they deserve it quite frankly, and you aren't one of them. So don't misinterpret this. Don't borrow to borrow. That is basically what you're doing. Especially if you're buying a house, which is a liability, not an asset. I don't care what your banker says. Assets put money in your pocket, they don't make you pay money. Screw GAAP and what the accountants think; a house is not really an asset. I suggest that you hang tight, unless if you're in a dire emergency situation, and save up some $$$ for a down payment. | ||||||

| 30 | Frick ID: 23117516 Tue, May 13, 2008, 13:49 |

Something to remember on mortgage payments. You don't reach the 50% paid off until around year 23. Making even small extra payments early can help speed up the payoff period considerably. Look to see what a 15 year mortgage vs. a 30 year mortgage will cost in monthly payments. Then make the 15 year payment on the 30. You pay off the 30 in around 15 years, but retain some flexibility in case of unexpected emergencies. As steep as the drops are for the major cities that Bili mentioned, they have been very mild in other cities. Granted those cities also didn't have the run-up prior. I would suggest setting a goal for what you want to pay, and start checking out the what is on the market. That way you can get a feel for what you can afford. When you decide to move forward take the number that you have in mind and reduce it by 10-15%. Your real estate agent will try and convince you to spend more (bigger commission for them). They can do this by tactics such as, look it is only $50 more per month, or you can't get all of the things you want for that price (location, # of bedrooms, etc.) | ||||||

| 31 | Perm Dude ID: 35455139 Tue, May 13, 2008, 13:59 |

We used realtor.com and other sites to narrow things down quickly. My wife still uses it to look at houses all over the place--I call it her "house porn." A good real estate agent won't waste your time (or theirs) doing much upselling, particularly with inventories so high. There should be plenty of housing to see if you are clear to them about your needs (and limitations). | ||||||

| 32 | The Beezer Dude ID: 191202817 Tue, May 13, 2008, 22:59 |

Great One, I think the essential question to determine if you're "throwing away" money for rent is the difference between renting and buying equivalent property. If you pay more to buy a place than to rent it (which for landlords/investors obviously is a bad situation unless other factors intervene), then you're essentially throwing away money on your mortgage. As Frick said in post 28, most of your money for a long time goes towards interest, which only partially reduces your taxes. Again, there are local variances, but for most folks out there I don't think now is a good time to be buying a home. Lots of good advice and discussion in this thread, so at least you're getting a lot of good looks at this. | ||||||

| 33 | Ref Donor ID: 539581218 Wed, May 14, 2008, 11:50 |

I've heard from financial planners that this is a great time to buy if you're not already owning as well. However, the point made earlier has merit. If home values continue to plummet--I mean the bubble had to burst at some time--then you are losing money (at least on paper and that hurts your PMI values). So by saving up for a better down payment, you're still getting the savings and move money in the bank. But there is some give and take here--especially if you can get a great deal. If you are planning on staying there awhile--then prices are going to eventually get back to were it's worth more than you paid. The house payment may be somewehre in the neighborhood of your rent--prob a little more and suddenly you have some equity. Even though you are paying pretty much all interest for awhile, you can use that as at tax deduction (though some states also allow rent as a tax deduction too). Also, you will have to put money into the new place for upkeep and intitially to get it the way you want it. Make sure you have money set aside for issues like that--esp. for older homes. Then you may have community associations, etc. that continues to eat away at your cash. Don't go into it and have to barely scrape by each month. But if you can swing it, even a lower-priced home than your ideal place, this is a great time to get a deal. Being able to put dwn 20% would be optimal, obviously. | ||||||

| 34 | Perm Dude ID: 32413148 Wed, May 14, 2008, 12:54 |

Good points, ref. I just wanted to throw out my own story here. I bought 5 years ago here in the Poconos, and really loved the place. But one thing that just about drove us to bankruptcy was the sudden (and unplanned for) increase in heating oil costs. When I first bought this place, heating oil was at about 90-92 cents/gallon, and last year went up to about $3.75/gallon. When you are heating 4300 square feet this starts to get into real money real fast. So in the next house I'd really try to budget out costs in a lot more detail than before. And (as ref says) make sure you have some room by not maxing out your budget. | ||||||

| 35 | biliruben ID: 33258140 Wed, May 14, 2008, 13:55 |

Very good points, Ref. I am budgeting 1% of the cost of the house for upkeep annually for my next purchase, as well as making sure I have 6 months of reserves in the bank so if a disaster occurs, we can still pay the mortgage. If you are planning on staying there awhile--then prices are going to eventually get back to were it's worth more than you paid. This, adjusting for inflation of course, may not be true. We could be, and I posit we are, at the high point, or just below the peak of the high point, in prices for the next hundred years. We may some time in the long distant future see another speculative bubble of this magnitude, but I hope to be dead by then. I submit that if you buy today, almost anywhere in the US, and potentially the world, your house will never, ever again be worth what you paid today. Period. This is Real Estate blasphemy, but I really believe it to be true. If you are only buying because you think your house will be appreciate in value, don't buy. Of course I could be wrong. | ||||||

| 36 | Frick ID: 23117516 Wed, May 14, 2008, 14:14 |

I think we will see a real estate bubble again in the not to distant future. Will it be as wide spread as the current bubble? Who knows. Bubbles have in the past been more regional, and more closely tied to the economic strength of the area, Dallas in the 80s for an example. I expect my house to be worth more in 10 years, granted i live in non-major metropolis and home prices haven't increased more than a few percent over the last 5 years. Compare that to major metropolises who have seen 30%+ increases? I live 2 hours from Chicago, but if my house was moved to a Chicago suburb in an equivalent neighborhood it would cost 3x as much. While I can see the value of homes in major markets decreasing significantly, I don't see the same being true in the areas didn't have the major run-ups in prices. | ||||||

| 37 | biliruben ID: 33258140 Wed, May 14, 2008, 14:27 |

Frick - Illinois has lost nearly a million people in the last decade. I'm hearing stories of numerous housing tracts outside Chicago with huge quantities of vacant properties. Why would you expect your house to go up in value, beyond just the effects of inflation? The area around Shaumburg has historically only been rivaled by Buffalo and inner-city Detroit in terms of breathtakingly cheap housing. I assume that's because nobody wants to live there. | ||||||

| 38 | biliruben ID: 33258140 Wed, May 14, 2008, 14:31 |

Well that's more harsh than I intended. Not nobody. Actuaries, for instance, love Shaumburg! It's their Mecca, if I recall correctly. Hopefully you don't live there, Frick. If so, I apologize for being unintentionally mean. | ||||||

| 39 | Great One ID: 56438112 Wed, May 14, 2008, 14:45 |

Jim Cramer says 18 months til housing is healed? just another opinion of course. Cramer video interview on The Street | ||||||

| 40 | biliruben ID: 33258140 Wed, May 14, 2008, 15:07 |

Generally, I think Cramer's a trained monkey, but I don't necessarily disagree with him here. I think the majority of the declines will probably be over in the next 18 months. That's saying the worst is behind us in Jan, 2011, about 3 and a half years after peak nationally. Yeah, that could be about right. Maybe a little optimistic, but not much. We may see another 5-20% after that over a 5-8 year period of generally flat or slowly depreciating housing markets, depending on region, probably mainly masked by inflation. That said, you have to realize where Jim's coming from: he is interested in stocks. He's saying the home builders, renovators, home-improvement retailers, RE industry, and all related things that haven't gone belly-up by then will start seeing improvement in their financials. He is NOT saying the housing prices will then start to rise significantly. In fact, he's saying that the only way we will see it even be that short until bottom is if builders continue to slash their prices nationwide, meaning continuing pressure on prices to the downside. | ||||||

| 41 | Frick ID: 23117516 Wed, May 14, 2008, 15:12 |

I live in Indiana just east of South Bend. I moved here from Indianapolis and home prices are a bit lower, but pretty comparable. I'm not arguing that Illinois has lost 1M people, but how many has the Chicago area lost? I'm guessing it has gained. The same can be said off almost any rural area. I grew up in a tiny town in southern Indiana, 50% of the people that I went to high school with no longer live there. The jobs just aren't there. Of the 50% that have moved, probably 25% are in Indianapolis or other larger cities. IMO the same trend is true of all most all small cities in the Midwest. That has been part of the rising home prices in large cities, demand was rising faster than supply. | ||||||

| 42 | biliruben ID: 33258140 Wed, May 14, 2008, 15:26 |

I may not disagree whole-heartedly with you, Frick. I think there will always be demand for nice walk-ups in Lincoln park. Maybe they went too high over the last five years, and will see some decline, but in general, people will pay a premium for living close to where they work, and that will hold up prices pretty well in-city. I'm not sure why you think that will have any effect on prices 2 hours out, however, where all you are competing for land-wise is with beans, corn and cows. | ||||||

| 43 | Boxman ID: 571114225 Thu, May 15, 2008, 21:34 |

The area around Shaumburg has historically only been rivaled by Buffalo and inner-city Detroit in terms of breathtakingly cheap housing. I assume that's because nobody wants to live there. Or......depending on who you ask I'm either a great neighbor or a crappy one. I can tell you why housing is comparably cheap in my neck of the woods. Traffic sucks and a lot of neighborhoods have 3 Mexican families living in one house. This is against village code but they never enforce it. God forbid though that you don't get a permit to put in a new toilet because the CSO will ticket you faster than you can blink. The traffic aspect is unforgiveable. Golf Road and Higgins Road are a joke during rush hour and if you don't know the exact location of the specific store you're looking for, forget it because the storefronts are so recessed back into the lots that you can't see anything. The village has also done a brilliant job of planting tall trees on the sidewalks so that they block the store signs. With all the car dealerships on those two roads, forget the weekends if car sales are hot with all the test drives. I do love this area of the world though because I'm 10 minutes from anything I need, I never have to rely on public transportation, and there's easy access to multiple arterial roads when there is snow or a bad accident so you have route options for your commute. | ||||||

| 44 | biliruben ID: 26435160 Fri, May 16, 2008, 09:24 |

Heh. While I was afraid of insulting Frick, Boxman, after that racially tinged, bizarro diatribe, I can insult guilt-free! ;) Win win! | ||||||

| 45 | Boxman ID: 337352111 Fri, May 16, 2008, 09:32 |

Racially tinged? It just so happens the families that do this in other parts of that area are Mexican. I don't care if it's three German, Irish, Polish, Hindu, Muslim, or Mexican families living in one home. It's against village code and causes a lot of unnecessary traffic on small side streets and other problems. Their 7 kids playing near the street at all hours of the day also increases the likelihood of a tragedy. | ||||||

| 47 | biliruben ID: 33258140 Fri, May 16, 2008, 12:36 | So if the race of the families doesn't matter, why did you specify their race? | ||||||

| 48 | Boxman ID: 337352111 Fri, May 16, 2008, 13:29 |

'Cause Stone Cold said so. Lighten up. | ||||||

| 49 | biliruben ID: 33258140 Fri, May 16, 2008, 13:34 |

Floatin' like a butterfly, slick. I actually took another look at Shaumburg's housing btw, and it ain't nearly as cheap as I remember when I looked at the stats 5 or 10 years ago. | ||||||

| 50 | ChicagoTRS ID: 4110481415 Fri, May 16, 2008, 13:58 |

Schaumburg is rather affluent...kind of yuppie-ish...it is close to a lot...close to airport...shopping...not far from downtown Chicago. If you want cheap housing in the Chicago area you are better off around 10 miles further west or south where you will pay ~$100 per square foot or less. Housing developments surrounded by corn fields...not many corn fields left in Schaumburg. | ||||||

| 51 | Great One ID: 56438112 Fri, May 16, 2008, 14:00 | Well this puts a dent in my savings... just got an IRS letter saying I owe them 1000 in taxes. I was unaware of this, but I settled a credit card a couple years back and was unaware that the amount of cancelled debt is considered income. Damn it! | ||||||

| 52 | Perm Dude ID: 194141614 Fri, May 16, 2008, 15:14 | Yeah, isn't that a kick in the pants? The amount the credit card company agrees to waive is "income" in the eyes of the IRS. Even though you're not getting it. And even though it is being negotiated off your potential debt because you won't ever get that money as income elsewhere to pay it. | ||||||

| 53 | biliruben ID: 33258140 Fri, May 16, 2008, 15:25 |

Yeah, they do the same on student loans. I figured out that, for my sister, if she paid the minimum for 25 years, they would then dispense with her loan (these rules changed recently, or maybe there's a bill out there that hasn't yet become a law). But she would then owe taxes on nearly half a million in "income", effectively bankrupting her on the spot. | ||||||

| 54 | Great One ID: 2241519 Sun, May 18, 2008, 14:43 |

On a side note to that story... I did have my taxes done at HR Block for that tax year and they never added that to my return (I have a notice from cc company in my HR Block folder so they definitely looked at it). Can they be held responsible for paying in any way? | ||||||

| 55 | GoatLocker Leader ID: 060151121 Mon, May 19, 2008, 14:27 |

Might be that you could get them to pay penalties and interest if they are there. Not really sure, but if it was me, I sure would try. Never know until you try. Cliff | ||||||

| 56 | Great One ID: 56438112 Thu, May 29, 2008, 11:51 |

Has anyone here ever bought a house via foreclosure? How does that work? It seems like a very different process. So my quick questions would be... Is their a "realtor" or agent of sorts to show you the different houses available? Can you finance the purchase? Are you allowed to see the houses and inspect them? Is the discount really that great? | ||||||

| 57 | Perm Dude ID: 420241913 Thu, May 29, 2008, 12:27 |

Most foreclosures are available via your realtor. You can find many through government sources and other places (I listed a few here). Yes you can inspect them, finance them, etc. But often they are sold as-is. | ||||||

| 58 | biliruben ID: 4911361723 Thu, May 29, 2008, 13:00 |

Here, foreclosure sales occur on the steps of the court house, you need to have a check ready to write for the entire purchase, and you often do not get a chance to inspect them first. There are well-financed professionals you are competing with that have been doing it for decades, and the best homes generally never get to the courthouse steps, but are bought pre-foreclosure. It's a complicated, non-transparent system that favors the experienced buyer. You could hire one, and have him buy a house in foreclosure for you, but I doubt you'd get much of a deal. Often the bank is the only bidder, and the house ends up on the market as REO. My suggestion is just go the normal route. | ||||||

| 59 | Frick ID: 23117516 Thu, May 29, 2008, 13:10 |

Just to clarify, are you trying to buy a house at the foreclosure auction, which is what Bili was referring to, or a house that was foreclosed on by the bank? Some banks will take a lower price to unload the property quicker to cut their losses. There are also short-sales, the current owner will be foreclosed on and the bank is again trying to cut their losses. If you are thinking about going either route I would suggest finding a real estate expert who has experience in the area. The house across from my prior house sold for 30% under current market value since it went through foreclosure. But it sat empty, with no utilities for 18 months and was trashed by the former owner. | ||||||

| 60 | skinneej Leader ID: 040625911 Thu, May 29, 2008, 13:49 | I have looked at buying "HUD" homes before, and there is good value in them, but be prepared for having to put some money into them for fixing up. The above advice is good about finding a agent who deals with foreclosed homes sicne they know the ins and outs better. About 10 years ago I looked into buying one of these, and I was able to go walk through them and have inspections done. You can finance them through normal methods although you might want to look into an improvement loan to be tagged on with your mortgage. Some are in great need of repair >20k where others only need 5-10k. Most states you will place a closed bid, but find out what the fee is that your agent gets which is part of your bid. For instance, I bid 98k on a home that appraised for 130k and it needed about 10k in improvements. My bid officially went in at 92k because of the 6% fee the agent would get as part of a successful bid. The winning bid was 102k with no fee so it was likely an agent who bought this to flip. Finding out the details of the bidding process in your area is key. Good Luck! | ||||||

| ||||||||

Post a reply to this message: (But first, how about checking out this sponsor?) | ||||||||