|

| Posted by: Boldwin

- [26451820] Tue, Nov 03, 2009, 05:04

The guru I trust most on economic matters, Nouriel Roubini:NYU economist Nouriel Roubini argued in the newspaper that by keeping federal fund interest rates at zero, Federal Reserve Chairman Ben Bernanke is stimulating a historic stock market rise that is being fueled by money investment managers borrowing from the federal government.Roubini warned that the dollar has become the "mother of all carry trades" and that it faces "an inevitable bust" that will cause asset prices to plummet in what will amount to a global stock market crash of historic proportions. A currency is defined as being involved in a "carry trade" when the currency can be borrowed at relatively low cost and invested for what appears to be a certain or "locked-in" gain. ...Asking rhetorically what is behind the stock market rally in which the Dow Jones Industrial Average has shot above the 10,000 benchmark after reaching a low of 6,547.05 on March 9, Roubini answered that the explanation lies in the dollar replacing the Japanese yen as the world's carry trade of choice, and that has caused U.S. stock markets to be hit by "a wave of liquidity from near-zero interest rates." Roubini's analysis was reminiscent of the attack launched against President George W. Bush that Federal Reserve Chairman Alan Greenspan had caused the "mortgage bubble" by keeping interest rates artificially low at 1 percent in 2003-2004 in order to stimulate the post-9/11 U.S. economy. ...As long as U.S. stock markets continue to go up, investors participating in the carry trade look like geniuses, Roubini argued, capable of realizing total returns in the 50-70 percent range since March. But the carry trade cannot last forever, Roubini warned. He said at some point the Federal Reserve no longer will be able to continue buying U.S. Treasuries and other federal agency debt securities in order to keep interest rates depressed. ...On March 24, a Federal Reserve Bank of New York press release specified that the Federal Open Market Trading Desk within the Fed would purchase $1 trillion of government and quasi-government debt, including up to $300 billion of longer-term U.S. Treasury securities, in what amounted to a government-subsidized purchase of U.S. government debt. The announced Fed purchases also included $750 billion of Freddie Mac and Fannie Mae debt and up to $100 billion of debt issued by various other government agencies. To many Americans, the move appeared equivalent to a retail consumer in debt using a MasterCard to pay the Visa bill. "But one day this bubble will burst, leading to the biggest coordinate asset bust ever," Roubini wrote. "A stampede will occur as closing long leveraged risky asset positions across all asset classes funded by dollar shorts triggers a coordinated collapse of all those risky asset Ė equities, commodities, emerging market asset classes and credit instruments." "This unraveling may not occur for a while, as easy money and excessive global liquidity can push asset prices higher for a while," he warned. "But the longer and bigger the carry trades and the larger the asset bubble, the bigger will be the ensuing asset bubble crash." "The Fed and other policymakers seem unaware of the monster bubble they are creating. The longer they remain blind, the harder the markets will fall." Getting sucked in by talk of the recession being over, or nearly over?Don't be. For the umpteenth time I tell you, simplify your lives people. You aint seen nothin' yet. |

| | | 1 | Perm Dude

ID: 154552311

Tue, Nov 03, 2009, 06:33

|

Heh. Predictable. In fact, predicted..

[W]hat's really going on here? I suspect that with the Dow Jones going back over 10,000, Republicans are looking for some other Very Simple Metric that shows Obama Stinks. The dollar looks like it's going to be declining for a while, so why not that? Never mind that the dollar was even weaker during the George W. Bush era -- they want people to focus on the here and now.

But you are a couple of weeks late on the memo--you really need to get these out quicker.

|

|

| | | 2 | biliruben

Leader

ID: 589301110

Tue, Nov 03, 2009, 08:06

|

I was reading that yesterday, Baldwin. Roubini was prescent with regards to the recession, and I take him seriously.

I think we could easily see a double-dip recession. and have been holding cash reserves in anticipation of a pull back in the market.

My prescription is probably different than yours, however. I think we need a second stimulus, where we focus on jobs - aid to states so they can keep schools open, money for construction projects, investment in electrical infrastructure. The things we skimped on the first time around, instead wasting stimulus on tax-cuts.

|

|

| | | 3 | Pancho Villa

ID: 49102937

Tue, Nov 03, 2009, 08:29

|

Bili,

That's basically what Krugman is saying in today's column.

|

|

| | | 4 | biliruben

ID: 16105237

Tue, Nov 03, 2009, 08:55

|

Heh. Yeah, he's been saying these sorts of things for a while. I will admit I read regularly.

He's not alone in this, however. Most serious Keynesians are saying similar things.

|

|

| | | 5 | boikin

ID: 532592112

Tue, Nov 03, 2009, 10:49

|

from 3:

I was just watched a PBS report on unemployment and they were saying that this recession has been disproportionately hitting older workers vs younger workers.

Interesting post on "carry trades". I am not sure what Krugman's arguement is in relation to the "dollar bubble", outside of more stimulus would lead to a greater "dollar bubble".

I heard for new term for what type of recession this will be and probably the one I agree with most and that is the squareroot shaped, or it goes down come back up and the levels off before it ever gets back before things return fully to "normal".

|

|

| | | 6 | Biliruben movin

ID: 358252515

Tue, Nov 03, 2009, 11:27

|

Prolly as good a guess as any...

|

|

| | | 7 | Boldwin

ID: 26451820

Tue, Nov 03, 2009, 11:51

|

PD I doubt you can back up the claim that Nouriel Roubini is partisan or even remotely tied to spinning this for political advantage. Unlike yourself.

|

|

| | | 8 | Boldwin

ID: 183112613

Wed, Apr 28, 2010, 11:33

|

The Bubble is Back

The stock market bubble that is.

|

|

| | | 9 | Boldwin

ID: 183112613

Wed, Apr 28, 2010, 11:35

|

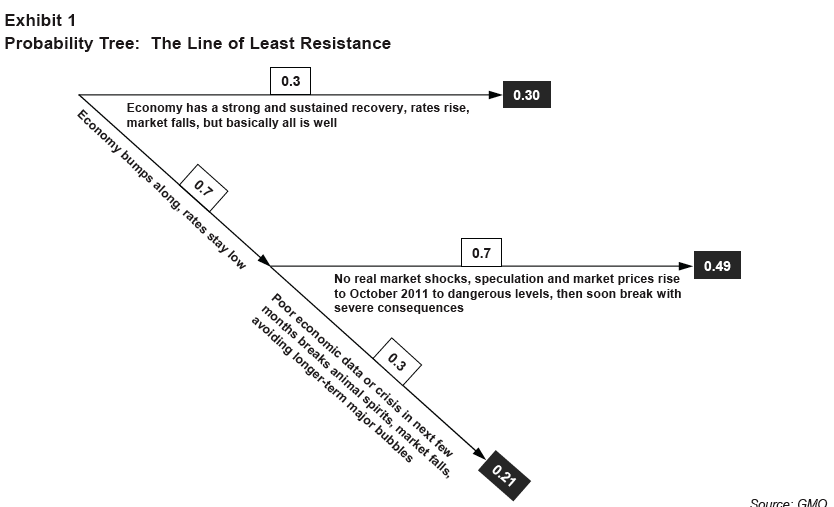

There is cash in a fantasy sports magazine with that sort of probability tree for each player.

|

|

| | |

| | | 11 | Boldwin

ID: 225201921

Sat, Jun 19, 2010, 22:21

|

The Euro floundering as poorer socialist countries without the ability to devalue their currencies to pay off their social over-promises are beginning to lean too heavily on the more stable members of the EU. Where will it end?

Rahm Emanuel is far from the only member or puppet of the power elite who 'never lets a crisis go to waste' so it will be interesting to see how they milk this crisis and where they drag the unwilling.

|

|

| | | 12 | Boldwin

ID: 225201921

Sun, Jun 20, 2010, 00:32

|

Medvedev pushes the Russian rubble as the next reserve currency.

Crazy idea? I read somewhere that they have completely eliminated their national debt. Despite years of blather about the threat from the West, they knew they could drop their defenses from a non-threatening West, take their own peace dividend and pay their bills.

While big government central planners in the USA congress spent their country bankrupt, Russian central planners who couldn't do anything else right after driving down expectations of what the state could reliably deliver thru decades of failure, used the one advantage they did have and put their country's money where it needed to go for once.

|

|

| | | 13 | Boldwin

ID: 15528202

Sun, Jun 20, 2010, 03:28

|

Germany's Leader chides Obama for his call for more government spending worldwide. A 'Keynes' Call', we could call it.

I am of course the only one here able to connect these dots.

|

|

| | | 14 | Building 7

Leader

ID: 171572711

Sun, Jun 20, 2010, 07:45

|

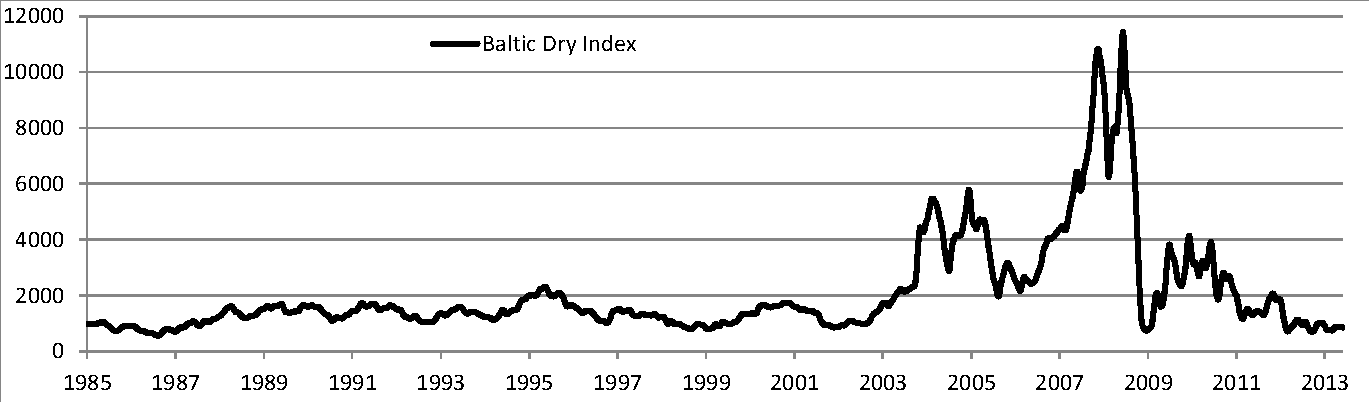

What about me. I've been anti-Keynes for a long time. And told people to learn about the Austrian School of Economics.

|

|

| | | 15 | biliruben

ID: 16105237

Sun, Jun 20, 2010, 12:59

|

Merkel's a moron.

There is no economic model that justifies austerity in the face of double digit unemployment and interest rates against the lower bound.

Needless screw-the-poor propaganda.

|

|

| | | 16 | Boldwin

ID: 15528202

Sun, Jun 20, 2010, 13:24

|

You are the man, B7. Now connect the dots. Our marxists insist on doubling down on the 'counter-cyclical' government spending and Russia is ready to pounce and declare the failure of the Western economic model. When in fact they've been practicing the austerity measures we should have been and we've bankrupted ourselves with marxist class warfare spending.

|

|

| | | 17 | bibA

ID: 545402012

Sun, Jun 20, 2010, 13:41

|

Lemme get this straight. If Reagan and the Bush's spend mucho dinero on defense, it is a good thing. If Clinton and Obama do it, it is marxist class warfare spending.

|

|

| | | 18 | Boldwin

ID: 15528202

Sun, Jun 20, 2010, 14:10

|

In all honesty, Reagan was forced to compromise and drastically overspend domestically in order to get his 'victory in the cold war'. Guess who forced that half of the spending?

Bush was a globalist perfectly happy to overspend on 'compassionate conservatism, which simply meant give the liberals the social spending they want and dream they might like you for it.

But of course it's not the president's primary responsibility. The marxists in the House hold the purse-strings.

|

|

| | | 19 | Perm Dude

ID: 5510572522

Sun, Jun 20, 2010, 14:19

|

Yes, and when those "Marxists" were Republicans most on the Right were silent, as all good partisans are.

Deliberately cutting taxes for the most wealthy while fighting two wars with the blood of the working class is about the most perfect example of "class warfare spending" you'll find. Now the US is left with a deficit with the largest component being the tax policies of the previous administration. Somehow this is Obama's fault...

Meanwhile, Baldwin and others rail against "one world" government but cheer on the gold bugs who would have us hand over domestic fiscal policy to a gold standard under the control of corrupt third world countries with huge gold reserves. Nice.

|

|

| | | 20 | Boldwin

ID: 15528202

Sun, Jun 20, 2010, 19:38

|

You see me as a gold bug? No one remembers what the other one says it seems.

|

|

| | | 21 | Boldwin

ID: 15528202

Sun, Jun 20, 2010, 20:00

|

Not that there's anything wrong with that. I find it very amusing the way gold bugs fry Obamamaniacs.

|

|

| | | 22 | biliruben

ID: 358252515

Sun, Jun 20, 2010, 20:16

|

Fantasy-based analysis is what fries me. There is an entire

descipline called economics, and merkelheads and gold bugs

choose to ignore basic lessons proven through mathematics

and experience.

Self-imposed ignorance is a quality I find incredibly ugly.

|

|

| | | 23 | Perm Dude

ID: 5510572522

Sun, Jun 20, 2010, 21:43

|

You see me as a gold bug?

Well:

You are the man, B7.

Baldwin and others rail against "one world" government but cheer on the gold bugs

For a guy who prides himself on "connecting the dots" this must be a real teachable moment.

|

|

| | | 24 | Building 7

Leader

ID: 171572711

Sun, Jun 20, 2010, 21:58

|

Self-imposed ignorance is a quality I find incredibly ugly

Then why do you do it.

It all boils down to who do you want in charge of the currency? Do you want the bankers and government in charge......then you would prefer the current paper money system. Where unlimited supplies of money can be created at virtually no cost. Where bankers have first access to this money. Where we are currently $14 Trillion in debt. 90% of GDP. $46,666 for every person in the country.

Or do you prefer an honest system of weights and measures based on gold and silver. As prescribed in the Constitution. The system of the common man, that favors no one. Where it would not be possible to sell the next generation down the river.

|

|

| | | 25 | Perm Dude

ID: 5510572522

Sun, Jun 20, 2010, 22:08

|

It simply isn't true that there is no cost to printing money--inflation is the result of more money being printed.

The time before we went off the gold standard is one of wild lurches between panics and depressions, with virtually none of the economic security that gold was supposed to provide (and, in fact, didn't). In fact, the inelasticity of gold is what makes it a poor standard upon which to base domestic fiscal policy.

There is nothing more "honest" about gold. In fact, basing monetary policy on an open market is probably much more "honest" than one which turns over our money backing to African and Russian mining operators.

|

|

| | | 26 | biliruben

ID: 358252515

Mon, Jun 21, 2010, 13:39

|

Individuals incapable of complex thought that hold an inability

to look at historical experience, and an irrational reverance for

shiny metals, should not be dictating fiscal and economic

policy.

|

|

| | | 27 | Boldwin

ID: 545192117

Mon, Jun 21, 2010, 18:19

|

PD

You have not provided any evidence I have recommended hoarding gold.

Why that would torque you off so badly [if it were true] I find just screamingly hilarious anyway. Is it the implicit lack of faith in your false messiah?

|

|

| | | 28 | Perm Dude

ID: 5510572522

Mon, Jun 21, 2010, 18:22

|

I never said you recommended hoarding gold. If you insist on charging people with accusations they aren't making, it will be a long day...

|

|

| | | 29 | Boldwin

ID: 545192117

Mon, Jun 21, 2010, 18:22

|

It simply isn't true that there is no cost to printing money--inflation is the result of more money being printed. - PD

That isn't a cost, it's a desirable feature to the people spending us down the river.

|

|

| | | 30 | Boldwin

ID: 545192117

Mon, Jun 21, 2010, 18:23

|

Then explain #23 to me.

|

|

| | | 31 | Perm Dude

ID: 5510572522

Mon, Jun 21, 2010, 18:23

|

Of course it is a cost. When the value of the medium of exchange goes down, that is a cost by definition.

|

|

| | | 32 | Boldwin

ID: 545192117

Mon, Jun 21, 2010, 18:26

|

It is a huge cost to the public. It is a a huge benefit to the political hucksters who overpromise and then need to inflate the currency to pay for it.

|

|

| | | 33 | Perm Dude

ID: 5510572522

Mon, Jun 21, 2010, 18:30

|

Nonsense. It is of no benefit to politicians to pay off debt with devalued currency since that debt is accompanied by interest to be paid as well.

Regarding #23: The difference between being accused of cheering on the gold bugs and being a gold bug yourself is the difference between cheering on the soldiers landing on the flotilla and being Jewish.

I never accused you of being a gold bug. Merely used your own words to demonstrate you cheering one on.

|

|

| | | 34 | Boldwin

ID: 545192117

Mon, Jun 21, 2010, 20:44

|

The politician couldn't care less about paying for his promises. The only thing he cares about is whether you the voter care more about the long term cost, or the short term handout he is promising and judging by their conduct, you have to conclude that if you aren't in the tea party, you just don't care about the over-spending.

|

|

| | | 35 | Perm Dude

ID: 5510572522

Mon, Jun 21, 2010, 21:32

|

If that was true, you'd see double digit inflation because there would be no disincentive to just printing up more money.

Your own assertions are rebutted by reality.

|

|

| | | 36 | Boldwin

ID: 545192117

Tue, Jun 22, 2010, 01:53

|

Time will tell. I don't think they will have any choice. The national debt is growing three times as fast under Obama as it was under the spend-a-holic Bush & congress. We are not growing our way out of it so you tell me how it gets paid for without printing money? Infinite Chinese loans?

|

|

| | | 37 | Perm Dude

ID: 5510572522

Tue, Jun 22, 2010, 02:22

|

Do you believe we will ever get out of this recession? If no, then we're all screwed and none of this matters.

If you do, then increased tax revenues will cover, in part, some of the increased costs we are incurring in order to keep people working. We then need to keep tax-cut-and-spend Republicans away from the till.

|

|

| | | 38 | Boldwin

ID: 545192117

Tue, Jun 22, 2010, 04:21

|

For now the American Dream is dead with no Prince Charming on the horizon.

The last thing we need is what we are going to get. More taxes to pay for public sector jobs at the cost of a healthy private sector.

|

|

| | | 39 | biliruben

ID: 34435239

Tue, Jun 22, 2010, 09:00

|

I guess people see what they want to see, and it's not surprising when end-of-timers only see gloom an doom.

Is there any evidence for any of your pronouncements in 38 beyond your imagination, Baldwin my dour-puss friend?

I agree if we don't supplement an anemic and ending stimulus with something more potent to get the economy going and people working again, we are in a for a bit of a long-slog of a recovery. Maybe even double-dip. But the borrowing that it would take to do that, while contributing a fraction of a percent to our long-term debt, appears to be the bogeyman in even normally rational folk's closets.

|

|

| | | 40 | Pancho Villa

ID: 29118157

Tue, Jun 22, 2010, 09:01

|

More taxes to pay for public sector jobs at the cost of a healthy private sector.

For those interested in reality, the private sector is, in many cases, surviving through government contracts.

I currently have two contracts through Rimrock Construction which are HUD financed, Layton Health Care and Brickstone Apts. My project manager at Rimrock told me HUD projects are really the only game in town at the moment. These projects support a litany of private sector trades(including me, of course), and will be owned and managed privately when completed.

Just a few miles from my house, the private sector stands to benefit greatly from the new NSA spy facility.

Major players in the Utah construction industry are bidding to build the U.S. National Security Agencyís $1.5 billion spy facility at Camp Williams.

Today, Big D Construction held an open house at their Salt Lake Office in an effort to bring local contractors and sub-contractors together for the project bid.

ďThatís going to be important for Utah,Ē said Big D Construction President, Rob Moore. ďUtah right now is in a downturn and we need jobs. Weíre very grateful to have a project like this.Ē

When the project is complete, it will employ thousands of well-paid computer geeks and support staff. They will be buying houses, patronizing retail and generally contributing to the health of the private sector.

the American Dream is dead

That may be true for those with such a defeatist approach to life. The term self-loathing appears to fit.

|

|

| | | 41 | Boldwin

ID: 545192117

Tue, Jun 22, 2010, 20:58

|

PV

If you think Obama and crew isn't intent on shifting the balance of public/private sector then we really live in two different realities.

|

|

| | | 42 | Pancho Villa

ID: 29118157

Tue, Jun 22, 2010, 21:13

|

It doesn't matter what I think. I just gave you real life facts. You can choose to ignore them, which is your reality. Maybe your American dream is dead. If so, it's your own doing and I'm sorry. I guarantee you there's plenty of us in the private sector who are doing just fine.

|

|

| | | 43 | biliruben

ID: 34435239

Tue, Jul 13, 2010, 00:15

|

Risk of Japan Style deflation on the near horizon.

Makin's a Conservative. Right-wing think-tank, with intellectual cred. Maybe this will wake you crazed deficit hawks the fuk up.

Many market participants and policymakers have warned that such aggressive easing will lead to inflation. Contrary to those expectations, as noted above, core inflation has steadily moved lower in the United States and Europe and is approaching outright deflation, which Japan is already experiencing. By later this year, persistent excess capacity will probably create actual deflation in the United States and Europe. Moreover, the recent appreciation of the dollar, especially against the euro, exacerbates the U.S. deflation threat.

----

At this point in the postbubble transition to deflation, fiscal rectitude and monetary stringency are a dangerous policy combination, as appealing as they may be to the virtuous instincts of policymakers faced with a surfeit of sovereign debt. The result of Europe's embrace of fiscal rectitude will be--paradoxically in the eyes of some--to export deflation to the United States, Asia, and the emerging markets. Additionally, Japan's new government's proposal to double the consumption tax as a way to promote growth has been appropriately chastised by the opposition Your Party leader Yoshimi Watanabe, who retorted: "Boosting the economy with a tax hike? That is an obscene stretch." Japan is threatening to repeat its disastrous experience of 1997, when a consumption tax hike threw the economy back into a sharp slowdown followed by intensified deflation.

A nice graph from Krugman:

We are right well screwed unless Obama ignores the twits screaming socialist, and starts spending some money to get people working and increase demand. Quick.

|

|

| | | 44 | Perm Dude

ID: 5510572522

Tue, Jul 13, 2010, 00:41

|

Clearly Obama needs to announce rapid and across the board spending cuts. That way the GOP will suddenly become spending demons, taking Obama to task for not understanding how "real America" is suffering and therefore the government needs to extend UI benefits, put together another stimulus package, and spend billions on job training programs.

|

|

| | | 45 | biliruben

ID: 34435239

Tue, Jul 13, 2010, 00:57

|

heh. That might just work!

It's like using reverse psychology on my 3 year old.

Except the GOP won't figure out they are being played quite as fast.

|

|

| | | 46 | boikin

ID: 532592112

Tue, Jul 13, 2010, 13:38

|

A nice graph from Krugman:

A nice graph of what?

|

|

| | | 47 | biliruben

ID: 358252515

Tue, Jul 13, 2010, 13:46

|

Sorry. I'll try get you a link tonight, but the y-axis is inflation

and the x-axis is time.

Don't have access to a computer right now, but you can

easily find the post on krugmans blog.

|

|

| | |

| | | 49 | biliruben

ID: 34435239

Wed, Jul 14, 2010, 00:09

|

Danke.

|

|

| | | 50 | biliruben

ID: 34435239

Wed, Jul 14, 2010, 01:16

|

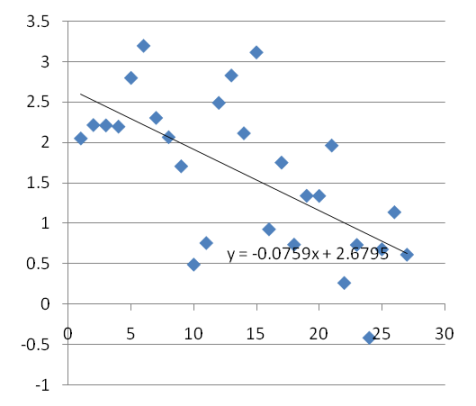

Well, a crude approach would be simply to fit a trend line through those noisy monthly numbers. Hereís what happens when you do this for the Cleveland Fedís median consumer price inflation number. On the vertical axis is the monthly inflation at an annual rate, on the horizontal axis months with Jan. 2008=0:

|

|

| | | 51 | biliruben

ID: 34435239

Wed, Jul 14, 2010, 01:30

|

Transparent baiting:

Marxists.org

Actually some nice histories of really old-school economists and philosophers.

|

|

| | | 52 | boikin

ID: 532592112

Wed, Jul 14, 2010, 09:42

|

Re: 48, It would appear to me that the only thing the article shows is that housing prices are decreasing since 08, which I am sure no one is going to disagree with.

|

|

| | | 53 | biliruben

ID: 34435239

Wed, Jul 14, 2010, 09:48

|

I would disagree with it.

Housing prices are up.

|

|

| | | 54 | biliruben

ID: 34435239

Wed, Jul 14, 2010, 09:54

|

So the first half of the graph, housing prices were continuing to drop precipitously. The second half of the graph, they were flat to rising.

This actually makes a stronger case that we should be extremely concerned about deflation, because one of the major factors is actually working to buoy inflation yet we see it rapidly plummeting towards zero, and perhaps beyond.

|

|

| | | 55 | Boldwin

ID: 57311817

Sun, Aug 18, 2013, 18:31

|

|

|

| | | 56 | sarge33rd

ID: 3871221

Sun, Aug 18, 2013, 19:59

|

"Subject: US Currency - The Next Bubble To Burst

Posted by: Boldwin - [26451820] Tue, Nov 03, 2009, 05:04" {emphasis added}

from the OP

just sayin....

|

|

| | | 57 | Boldwin

ID: 49572022

Fri, Jul 17, 2015, 10:18

|

After the bubble burst China just experienced, they appear ready to announce a gold backed Yuan.

A gold backed world reserve currency is enormously appealing these days of global quantitative easing madness.

I've said all along that a successful shift in the world's reserve currency would signal the end for America. Can't kite checks anymore. Can't prop up the country with T-bill sales anymore. Can't keep living beyond means. There has been a radical shift in how much of the national debt is owed to foreigners under Obama.

It's gonna get ugly quick.

These sorts of things ultimately get sorted by world wars.

|

|

| | | 58 | biliruben

ID: 81382416

Fri, Jul 17, 2015, 11:55

|

You wish, doomer.

One question: What is the 1-year return in the Shanghai Composite Index?

|

|

| | | 59 | Boldwin

ID: 49572022

Fri, Jul 17, 2015, 13:13

|

There is a crash of epic proportions going on. Do you see something I don't in that? Some silver lining? They aren't letting large shareholders sell off, all kinds of extreme measures.

...like going to a gold standard to stabilize things.

|

|

| | | 60 | biliruben

ID: 561162511

Fri, Jul 17, 2015, 14:28

|

Answer the question.

|

|

| | | 61 | biliruben

ID: 561162511

Fri, Jul 17, 2015, 14:49

|

Fine, I'll tell you. It's up 92%. At it's high, it was up 151%.

With a run-up like that, a 30% dip is a minor correction, not a "crash of epic proportions".

Get some perspective, doomer.

|

|

| | | 62 | Boldwin

ID: 49572022

Fri, Jul 17, 2015, 17:31

|

If you want to look at it that way, the basis was originally 100 and it was over 5,000 at it's highest.

Yeah the run-up was epic too.

Do you think when a market is so out of control that the government makes it illegal for major classes of investors to even trade that it's a normal market correction? Do you think that when China halts trading in 30% of stocks, that it's no big deal?

The fact is that China's financial foundation is resting on a mountain of bogus paper. Those brand new empty cities are the tip-off. Everyone knows it. The shadow banking system is like our sub-prime market was before the crash. All it takes is a trigger for the panic to set in.

I also don't think it's a coincidence that China ran a cyberwar operation against USA targets during this timeframe.

|

|

| | | 63 | Boldwin

ID: 49572022

Sat, Jul 18, 2015, 12:35

|

BTW bili, yeah, I noticed the 92% figure in the first google return as well.

|

|

| | |

| | | 65 | Boldwin

ID: 49572022

Sat, Jul 18, 2015, 21:57

|

I'd point you to the Real Estate Bubble thread I posted nearly 2 years before the 2008 debacle but the first two iterations of that thread were deleted somehow. Here is that thread's third version, itself started in 2007.

You will find that my prediction for what will happen when the world reserve currency changes will hold up as well. A prediction I've made well in advance and emphasized plenty hard.

|

|

| | | 66 | Boldwin

ID: 49572022

Sat, Jul 18, 2015, 22:11

|

This guy has a pretty successful track record too.

|

|

| | | 67 | biliruben

ID: 561162511

Wed, Jul 29, 2015, 16:55

|

What prediction? What reserve currency change? What are you talking about.

I was calling a housing bubble on this board in 2003, for what it's worth. I don't think it had anything to do with currencies though.

Please map out what you think will happen if what? China goes on the gold standard? The Euro usurps the dollar? I remember your predictions. And I also remember thinking you don't understand macro economics even a little bit.

|

|

| | | 68 | Boldwin

ID: 49572022

Wed, Jul 29, 2015, 18:05

|

It's already unfolding. The result of China's massive prolonged gold buying binge [fundamental to the power of their currency] and prolonged trade surpluses with the rest of the world means that...

The BRIC countries [to begin with] start ignoring us economically and route around us. The world's economy will eventually route through Chinese banking. [think what the power of the 'City of London' financial district has meant to the Anglo-American world power] Will it be a gradual switch?

All those petro dollars floating around the world will start flooding back to us, seriously reducing the value of the dollar.

Most devastating will be that our T-bills will go unsold [as their importance will diminish as securities] and thus our credit card [to keep funding all this overspending you keep telling us doesn't matter] will be cut in half.

We will no longer be able to print monopoly money to get us out of trouble. Instead we will be borrowing at higher and higher rates to pay the interest on an unpayable national debt.

That your pie-in-the-sky utopian social project overspending will be impossible, will be a cold comfort "I-told'ya-so".

|

|

| | | 69 | Boldwin

ID: 49572022

Wed, Jul 29, 2015, 18:43

|

Addendum:

I really had a chuckle over the suggestion, 'The Euro usurps the dollar?'

The Euro is a basketcase. The whole project is in imminent peril. There's scarcely more than two functional economies on the hook propping up the rest of a severely bankrupt Euro-zone.

Wait till they have to start paying for their own defense.

Do that math.

Yeah, China will go gold standard. I don't understand the mechanics of what that will mean. There isn't enuff gold on the planet to make all their currency convertable AFAIK, but it will be something gold-standard-ish.

They are in the process of buying us, piece by piece.

Eventually this will all get sorted out in a world war instead.

You can only hand people monopoly money for so long. Every country that can get away with it is on a quantitative easing race to beggar- thy-neighbors and pay debts with inflated money. That won't end well.

|

|

| | | 70 | biliruben

ID: 81382416

Wed, Jul 29, 2015, 23:14

|

Right, except Euro usurping the dollar was your prediction 8 or so years ago. Prediction number 15211 that you were absolutely dead wrong on.

Reading zero hedge decreases your IQ by 1 point an hour.

Post 68 is absolute nonsense. That's not how currencies work. Dollars don't flood back anywhere. You have no idea about how the world economy works. I hope you aren't risking real money and your muddled thinking, for you wife's sake.

|

|

| | | 71 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 09:33

|

The people who actually run the world, the Buildergergers, Rothchilds etc seem obviously to me to have every intention of setting up a world government with it's capitol in Brussels. That doesn't mean they will make the euro the world's currency.

The EU is just their stepping stone.

No I did not foresee the EU being quite the basketcase it has become seemingly overnight.

Zerohedge understands the markets so deeply they make your understanding look like an oil slick on the ocean.

Read Jim Rickards [as I have] whom the CIA turned to to help them understand the world's money and the financial threats we face.

Then we can have an intelligent conversation and you won't need to lean on ad hominem, slander and the advantages of leading the adoring bandwagon against the lone 'thinker outside the box'.

|

|

| | | 72 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 09:38

|

And before you go assuring everyone that something I said is naive and unthinkably stupid, try googling the thing I said and see all the intelligent informed people whose company I keep.

|

|

| | | 73 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 09:52

|

Fun fact:The dollar is a major form of cash currency around the world. The majority of dollar banknotes are estimated to be held outside the US. More than 70% of hundred-dollar notes and nearly 60% of twenty- and fifty-dollar notes are held abroad, while two-thirds of all US banknotes have been in circulation outside the country since 1990 Make sure you got that right, bili, cause if they actually can come flooding back...

|

|

| | | 74 | biliruben

ID: 28420307

Thu, Jul 30, 2015, 09:56

|

Looking at the top 5, I don't see any signs of intelligent life, captain.

followthemoney.com

peakoil.com

zerohedge

survivalistboards

libcompass

Just explain, step by step, how you expect the markets to react to some government doing what you say they will do. Step by step. Action, reaction.

Show me you know something besides hysteria.

|

|

| | | 75 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 10:18

|

Really? 145,000 returns for "petrodollars flood back home", and heaven forfend the top five believe that's a superbad problem or even that that's possible. That the world economy works that way. Preposterous idea no sane person would consider.

Most dollars are held by foreigners who need those dollars to buy oil, etc, but mainly oil.

What if the reserve currency becomes the yuan or IMF special drawing rights or who knows, bitcoins?

Suddenly those dollars will come back to the USA, buy an asset and stay in the USA from that time forward.

Think that would be inflationary much? Think the dollar in your bank account is still worth the same?

|

|

| | | 76 | biliruben

ID: 28420307

Thu, Jul 30, 2015, 10:26

|

I'm just trying to get the muddle out.

So step 1. A country starts to hold Yuan as a reserve currency. Okay.

So step 2...

|

|

| | | 77 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 10:34

|

Further, banks around the world hold USA treasuries as securities to prove they are legitimate institutions.

What happens if they don't think they're all that reassuring?

The next time bili goes to the bank to support the extra 100,000 illegal immigrants who showed up this month...

...oops, no one showed up at the auction. Can't borrow anymore.

|

|

| | | 78 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 10:34

|

Off to breakfast with my dad. Later.

|

|

| | | 79 | biliruben

ID: 28420307

Thu, Jul 30, 2015, 10:44

|

There are smart folks who think like you do. Doesn't mean they aren't wrong.

Besides his job, how much did Bill Gross lose over the last 6 years making bets around just this sort of logic? 5 billion? 10 billion? Probably more.

I've made 2 bubble bets in the last 10 years:

1) I sold my house in 2007.

2) I double-shorted gold at $1900/oz.

I don't regret either.

|

|

| | | 80 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 12:06

|

Could we agree to something civil? Could you please admit that just maybe losing reserve currency status...just maybe...might see petrodollars come flooding back home?

Just maybe that's the way the world works after all?

Kinda like Kissinger in reverse?

|

|

| | | 81 | biliruben

ID: 28420307

Thu, Jul 30, 2015, 12:15

|

If you explain how it will work. I just don't see it, or what it even really means. Dollars don't move by themselves. They need to be used in a transaction to purchase a good, and there are 2 parties, a buyer and a seller.

Let's start there. What are the current owners of dollars going to buy that will be inflationary?

|

|

| | | 82 | biliruben

ID: 105572020

Thu, Jul 30, 2015, 14:09

|

Let's put aside the reserve currency question.

Let's look at a related idea, and maybw this us what yoi meant. just say that China starts to sell all those us bonds we hold. That might actually serve to weaken the dollar against the yuan. But that would also serve to improve our trade deficit and create more jobs for Americans.

That would be a good thing, and likely return to equilibrium fairly quickly.

I can't see how this would lead to hyper inflation.

|

|

| | | 83 | biliruben

ID: 561162511

Thu, Jul 30, 2015, 14:12

|

..they hold.

Hard to argue on a tiny, American made phone.

|

|

| | | 84 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 19:51

|

I gotta do this later.

There are two related issues here.

How this country goes about financing the deficit related to the country's perceived soundness.

And inflation.

The desirability of treasuries relates to the first.

A wild rise in monetary supply [flooding back home] leads to a wild rise in the price of something, whether it is stocks or RE/hard assets or food, etc. Likely everything.

You can divert the conversation into why QE hasn't already done that, and that would be interesting...but eventually the fundamental chickens come home to roost.

|

|

| | | 85 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 20:48

|

Basic transaction:

1) Greek oil buyer used to maintain a balance of US dollars because they would need them for oil imports.

2) Greek oil buyer buys something else with those dollars instead and starts holding yuan or renminbi or something else...

3) Whether those exchanged dollars go directly back to the USA immediately or not, they never again get held for oil purchases by that Greek oil buyer. Eventually the dollars end up back in the USA and as the demand for dollars has gone down they are likely to stay in the USA.

4) Bubbles and inflation at home are the result.

|

|

| | | 86 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 20:52

|

Equilibrium...yeah, that's not the panacea. But it is what we are headed for. Our wages are indeed surely being averaged with the rest of the 'living-on-$100-per-year' world.

Kumbaya

|

|

| | | 87 | Boldwin

ID: 49572022

Thu, Jul 30, 2015, 20:58

|

Average Chinese family income is 1/8 it's American counterpart.

May all those people who pushed the WTO see their incomes end up at the new normal. May they have to compete with slave labor for their next meal.

|

|

| | | 88 | biliruben

ID: 28420307

Fri, Jul 31, 2015, 01:04

|

Well, yeah. There is an ongoing competition for jobs, at all levels of the economic ladder. F'in capitalism and market forces are not the friend of the US worker.

Not sure what this has to do with reserve currencies however.

|

|

| | | 89 | Boldwin

ID: 49572022

Fri, Jul 31, 2015, 03:58

|

Capitalism didn't bring us down. Big government micro-managers, the exact opposite did. Treasonous treaties and trade deals did. Uber-wealthy Internationalists who wanted to bring America down did. Cultural marxists who hated all things American did.

|

|

| | | 90 | Boldwin

ID: 49572022

Fri, Jul 31, 2015, 04:00

|

Everyone with an anti-American agenda had discipline and persistence. The average voter didn't.

|

|

| | | 91 | biliruben

ID: 81382416

Fri, Jul 31, 2015, 10:52

|

The protectionism, distorting pure market forces, is marxism?

And George Bush committed treason?

Just trying to follow your, um, logic.

|

|

| | | 92 | biliruben

ID: 105572020

Fri, Jul 31, 2015, 13:18

|

Actually you are suggesting removing the protectionism is Marxism. That just silly.

|

|

| | | 93 | Boldwin

ID: 49572022

Fri, Jul 31, 2015, 16:49

|

'Competing' with slave wages held down artificially by a marxist government does not constitute free markets. It is also impossible. That trade war is over before it starts. As your closed factories demonstrate.

|

|

| | |

| | | 95 | Boldwin

ID: 2711516

Mon, Aug 17, 2015, 17:28

|

Interesting:

|

|

| | | 96 | Boldwin

ID: 2711516

Tue, Aug 18, 2015, 20:26

|

While I read a zillion people expecting a crash soon and that China will be the ignition point, the reporter I trust most claims China has turned the corner and nothing to worry about.

I wanna believe the crash will be delayed and that I have a year at least to prepare.

Please have it right Ambrose.

|

|

| | | 97 | biliruben

ID: 137281811

Wed, Aug 19, 2015, 11:27

|

What people? What sort of crash? Why?

|

|

| | | 98 | Boldwin

ID: 2711516

Wed, Aug 19, 2015, 20:02

|

It's a house of cards and you haven't even caught a whiff of it, have you?

Virtually every country is operating on unprecedented levels of quantitative easing to paper over economies and deficit spending out of control. Not a central bank lever left in sight that works anymore.

EU on the brink.

Japan on the brink.

Russia in panic mode and openly sabre rattling.

China with their banking system and stock market melting down.

USA so bankrupt it's very nearly mathematically impossible to recover. All the while taking on new creative entitlement burdens.

Vultures like Soros and hedge fund managers strip mining the wealth of America thru tried and true methods perfected in the Great Recession.

Unsupportable derivative overhangs greater than the combined wealth of the world many times over.

Companies relocating their headquarters in tax havens and making sure their profits never touch our shores.

Our military being hollowed out right before World War. Power abhors a vacuum.

America's enemies explicitly spelling out their plan to take us down as our own administration busses in muslim cutthroats from the most Islamist America hating impossible to assimilate countries in the world, like Somalia.

Really the only thing holding back the deluge is that the elites haven't finished sucking us dry.

The era of the functional nation state [and even functional regional union] is over and they are very very impatient to administer the death stroke and usher in their 'utopian' world government.

|

|

| | | 99 | Boldwin

ID: 2711516

Wed, Aug 19, 2015, 20:15

|

What's even more ghastly, 30% of America is actually ready to vote for a card carrying marxist so far to the left he can't stomach joining the Dem party.

They don't give a crap about western culture, surreptitiously side with the enemy every time. Join hitlerian anti-semetic BDS movements.

Think this picture is funny:

Walk Berkley wishing ISIS flag-wavers good luck.

And those are the people who are going to be in our foxhole during WWIII.

The ones who think Iran, the nukes we just guaranteed them, and the Russian warships now sitting in their harbors...

...should be trusted.

...and that American patriots are the real threat.

|

|

| | | 100 | Bean

ID: 14147911

Wed, Aug 19, 2015, 22:25

|

The amazing thing is that the only thing at risk in our economy is the currency. It is the illusion that holds everything together. When you no longer believe the illusion, then the economy falters. The chicken littles are the guys who have awaken from the dream. Whose illusion is best.....America for now.

Pay no attention to the man behind the curtain.

|

|

| | | 101 | Boldwin

ID: 2711516

Mon, Aug 24, 2015, 16:51

|

bili

That crash. Anyone wanna guess the bottom? Anyone brave enuff to bargain hunt?

|

|

| | | 102 | biliruben

ID: 28420307

Mon, Aug 24, 2015, 18:23

|

A long overdue correction. I'm starting to window shop, but I'll probably wait a bit.

|

|

| | | 103 | Boldwin

ID: 2711516

Mon, Aug 24, 2015, 21:33

|

Bet those connected hedge fund managers and insiders were so short on stocks at the start of this run that they were dancing with atoms.

|

|

| | | 104 | Boldwin

ID: 2711516

Tue, Aug 25, 2015, 18:28

|

"This is 2008 stuff" - Zerohedge

.

|

|

| | |

| | | 106 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 17:30

|

The supply of cargo ships is generally both tight and inelasticóit takes two years to build a new ship, and the cost of laying up a ship is too high to take out of trade for short intervals,[6] the way you might park a car safely over the winter. So, marginal increases in demand can push the index higher quickly, and marginal demand decreases can cause the index to fall rapidly. e.g. "if you have 100 ships competing for 99 cargoes, rates go down, whereas if you've 99 ships competing for 100 cargoes, rates go up. In other words, small fleet changes and logistical matters can crash rates.

- Wikipedia

|

|

| | | 107 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 17:31

|

Legendary gold expert Jim Sinclair says what is going on right now in the stock market is just the warm-up act. Sinclair contends, ďThis is a pre-crash, and we are not making it through September without the real thing. Everybody is on credit. Main Street is on credit. This seems to be a bubble of historical proportion when it comes to the amount of money supporting the accepted lifestyles as being the new normal. Raising interest rates is impossible today. The market is so fragile. Nothing can come out that causes people any concern or derivatives any change, nothing whatsoever. We are going through a period of time where expecting nothing meaningful is a dream. These are times never experienced in financial history. . . .It is very possible that we are going to have a super civilization change. Ē

The US Plunge Protection Team is losing control of the markets, and Sinclair warns, ďThey got the dickens scared out of them. They actually backed off providing the funds necessary. . . . Thatís your warning. The warning is markets can overrun plunge protection teams. Markets can and will overrun the manipulation of metals and currencies. The market will overrun the false strength in the US dollar. The idea that a lift in interest rates would be beneficial to the dollar is absolutely incorrect. We do know the limits of the Plunge Protection Team, and we do know the omnipotent power of the Fed is a total fallacy.Ē

|

|

| | | 108 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 17:33

|

If you believe that, it sounds like you should take out some credit and short the living shit out of the market.

|

|

| | | 109 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 17:48

|

Over time, the BDI is the best indicator of global economic health because, unlike the futures market, the BDI does not engage in speculation as it provide near real time data on what and what is being shipped. The determinations made by the BDI are such an accurate indicator of economic activity because businesses donít book freighters when they have no cargo to move. In short, the BDI is the worldís financial blood pressure measure. The BDI is said to be one day away from reaching its all-time low. - The Common Sense Show David Hodges

|

|

| | | 110 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 17:49

|

That's what the hedge funds are doing.

|

|

| | | 111 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 17:57

|

The chart sure looks like a trailing indicator.

If you were buying on credit at it's all-time high in mid-2008... Yikes.

And selling in 2009 when the market was poised to double inside of the next 2 years.

I'll skip the market-timing and cryptic rants from zero-hedge, thank you very much. That way leads to the fleecing of the sheep.

|

|

| | |

| | | 113 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 18:10

|

You bought a mega yacht? Cheated on your wife?

You're more cryptic than zero hedge.

|

|

| | | 114 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 18:13

|

Hedge funds are for suckers. Unless you are running them. If you win, you win. If you lose, you win.

If you give them your money, you sooner or later you lose. Ask all the pension fund managers who are telling them to take a hike.

|

|

| | | 115 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 18:22

|

I was speaking in my Elena Ambrosiadou voice.

|

|

| | | 116 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 18:27

|

She somehow misused the BDI in 2008 to convince herself to sell instead of buy?

Your feminine side isn't too bright, but perhaps lucky is better than smart.

|

|

| | | 117 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 18:44

|

Like all the hedge funds that made out like bandits, they were fully in position shorting the markets before the crash.

Another hedge fund is an interesting example. Steven Eisman convinced Obama to crush small independent colleges, by denying their students government subsidies...and then of course Eisman who previously became rich shorting the housing bubble, began shorting small private education.

The wealth being created today in America is largely connected cronys and insiders surfing America's decline as she circles the toilet bowl. And as they deliberately sabotage it.

|

|

| | | 118 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 18:48

|

That's what "hedge" means. Of course most did well before that crash.

If you really think they were able to predict the market because of some sort of insider info or some market indicator, than they are much stupider than I thought. We should all be owned by them right now, if that were the case.

Look at your latest heartthrob Elena's record lately by the way. It's pathetic since she tossed her quant husband overboard.

|

|

| | | 119 | biliruben

ID: 39256112

Wed, Aug 26, 2015, 18:50

|

Did well during the crash I mean. If they used BDI they wouldn't have, however.

You seem adept at one thing, and that thing is changing the subject.

|

|

| | | 120 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 19:01

|

She also threw out her entire research team in a fit of paranoid pique over who was supporting which side of the couple.

|

|

| | | 121 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 19:10

|

Had you reacted to the BDI when it went into freefall June-July 2008, by shorting housing, investment banking, etc...you would have made out like bandits after Sept when Lehman was allowed to go bankrupt and Goldman/Sachs and Morgan Stanley weren't.

|

|

| | | 122 | Boldwin

ID: 2711516

Wed, Aug 26, 2015, 19:13

|

I'll also point out that the BDI had a false drop in Feb of this year. The central banks barely averted disaster. But as you see from the 2008 BDI, one save doesn't win the soccer match.

|

|

|

|