|

| Posted by: biliruben

- [17502215] Wed, Aug 29, 2007, 12:31

Senator Obama has a RADICAL idea:

Actually have those responsible and benefited with massive profits bear some the risk and costs of clean-up

It's usually capitalism for the poor and socialism for the rich in these circumstances, so this is truly radical.

nscrupulous lenders who deceptively sold subprime mortgages to millions of Americans should be fined and the proceeds used to help bail out borrowers facing a wave of foreclosures, according to Barack Obama, the Democratic senator running to be his partyâs presidential candidate.

The proposal is among the most radical yet from a leading Democrat and comes as Washington tries to respond to a growing wave of foreclosures and a crisis in credit markets.

It also comes amid greater discussion in Washington on whether the mortgage industry â including credit rating agencies involved in rating mortgage-related securities â should be more tightly regulated to prevent a repeat of the crisis.

Writing in todayâs Financial Times, Mr Obama blamed lobbyists working on behalf of lenders for obstructing tougher regulation of the subprime industry, adding: âOur government failed to provide the regulatory scrutiny that could have prevented this crisis.

âWhile predatory lenders were driving low-income families into financial ruin, 10 of the countryâs largest mortgage lenders were spending more than $185m (â¬136m, £92m) lobbying Washington to let them get away with it,â he wrote, citing figures from the Centre for Responsive Politics.

Wall Street banks have also stepped up their lobbying over the issue of subprime lending as their underwriting practices come under scrutiny. It emerged this week that Citigroup paid $160,000 in the first half of this year for lobbying services from Ogilvy Government Relations.

Mr Obama said the government needed to âstop the unlicensed, unregulated, fly-by-night mortgage brokers who are hoodwinking low- income borrowers into loans they canât affordâ.

He added that âWashington needs to stop acting like an industry advocate and start acting like a public advocateâ.

Radical. |

| | |

| | | 2 | biliruben

ID: 17502215

Wed, Aug 29, 2007, 13:21

|

What I can't understand is who can afford even the bottom end of the Jumbos.

Here in Seattle where the median house is pushing 500K, they are obviously fairly common even with 20% down.

But our household income is in the top 10% or 15% for Seattle with little debt, yet we couldn't possibly afford a 417K mortgage. Our budget's tight at a third of that. Even fairly liberal front-end ratios wouldn't work without a stretch. This is a PITI of around $3300/mo. at 7% (which is pretty difficult to get).

Most of these must be interest-only or payment option Jumbos, is all I can fathom.

|

|

| | | 3 | Baldwin

ID: 125312919

Thu, Aug 30, 2007, 10:11

|

While I am no friend of ARM's, I don't see what makes the lender of an ARM loan unscrupulous any more than the stockbroker before the great depression who agreed to perform the leveraged purchases of the average man eager to get in on that bubble.

It's a tragedy to be sure. A friendly and stern warning during the process would have been nice, perhaps should have been legally mandatory, tho I am quite sure it wasn't.

Out of curiosity, what was the appraiser to do in all of this? Value the next house at the proven market price or more in line with larger economic realities and by what legal justification? And would it have been pragmatic? Could it have been done? Should banks holding more and more inflated paper have been hiring and insisting on such appraisers?

Should bank examiners have been demanding it?

I have been slowly doing the math...

Who ends up holding all the marbles when 1/5 [?] of all home buyers find out they were only renting? Did the lenders selling the ARM's manage to dump the majority of the paper off to investors?

Can it be proved that the guys ending up with all the marbles, planned and manipulated that outcome?

|

|

| | | 4 | Baldwin

ID: 125312919

Thu, Aug 30, 2007, 10:47

|

As an over-arching principle, the power-elite have always operated by selling the free passage to conduct piracy, something they have to sell by 'virtue' of having the corrupt power structure in their back pocket.

Is that what Citigroup was buying with their lobbying?

Francis Drake would have been the first one to recognize that just because it was perfectly 'legal' it could still be true piracy.

Accepted practice...hmmm.

How many industries are so corrupted that a man of principle can barely navigate a true path?

|

|

| | | 5 | Perm Dude

ID: 19758307

Thu, Aug 30, 2007, 10:51

|

All of them.

|

|

| | | 6 | Baldwin

ID: 125312919

Thu, Aug 30, 2007, 10:58

|

Well, we are all enjoined to walk a cramped and narrow path, true dat...

But not everyone in their work-a-day world is faced daily with dilemas as accute as Sarge is trying to force on pharmacists for example. I am trying to imagine my son working in a loan department. What would he do? Some bright-eyed young couple walks in, can't swing the payments on a regular loan just yet...

|

|

| | | 7 | sarge33rd

ID: 99331714

Thu, Aug 30, 2007, 11:06

|

lol nice attempt at an irrelevant snipe Baldy. I'd turn it around, and say not all are faced with the difficulties as you'd create by forcing patients to travel 50 miles for scrips, cause their local pharmacist is jamming his/her religion down the patients throat.

|

|

| | | 8 | Perm Dude

ID: 19758307

Thu, Aug 30, 2007, 11:08

|

I think the problem is much more acute in the financial industries, where people's jobs are, essentially, to make money by moving money around.

|

|

| | | 9 | sarge33rd

ID: 99331714

Thu, Aug 30, 2007, 11:14

|

hate to keep turning it to "my" industry...but in this industry, there are SO many disclosure requirements in place its bordering on absurd. For ex, in some states, dealer cost on Service Agreements are required to be DISCLOSED. The dealer F&I personnel, are required to disclose each and every detail of the financing being offered. So why is it, or how is it, that on home loans, the "seller" of the financing, is under far less federal scrutiny? And cell phone providers? I'd hate to give serious thought to how many hundreds of thousands of dollars monthly, consumers are bilked out of by that industry, through non-disclosure of the true terms.

|

|

| | | 10 | biliruben

ID: 4911361723

Thu, Aug 30, 2007, 12:29

|

I agree with your general sentiment, Baldwin.

The issue is one of transparency and regulation. Certainly not all mortgage originators of various stripes are unscrupulously trying to screw the borrower for gain, but certainly some, perhaps most over the last few years certainly were.

The problem as I see it is that the unsophisticated and knowledgeable borrower put their trust in brokers that for the fee paid they would navigate the difficult world of mortgages, and that they had a fiduciary responsibility to put the borrower's interests before there own.

This wasn't true, and I submit that it should be. We really need national licensing of mortgage originators to get rid of all this shysters.

|

|

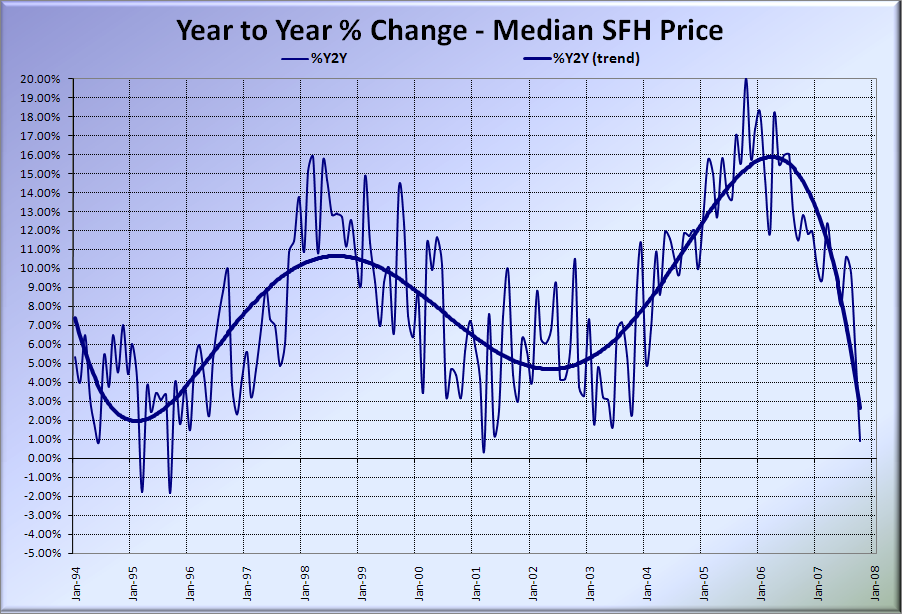

| | | 11 | Baldwin

ID: 125312919

Thu, Aug 30, 2007, 13:43

|

Biliruben

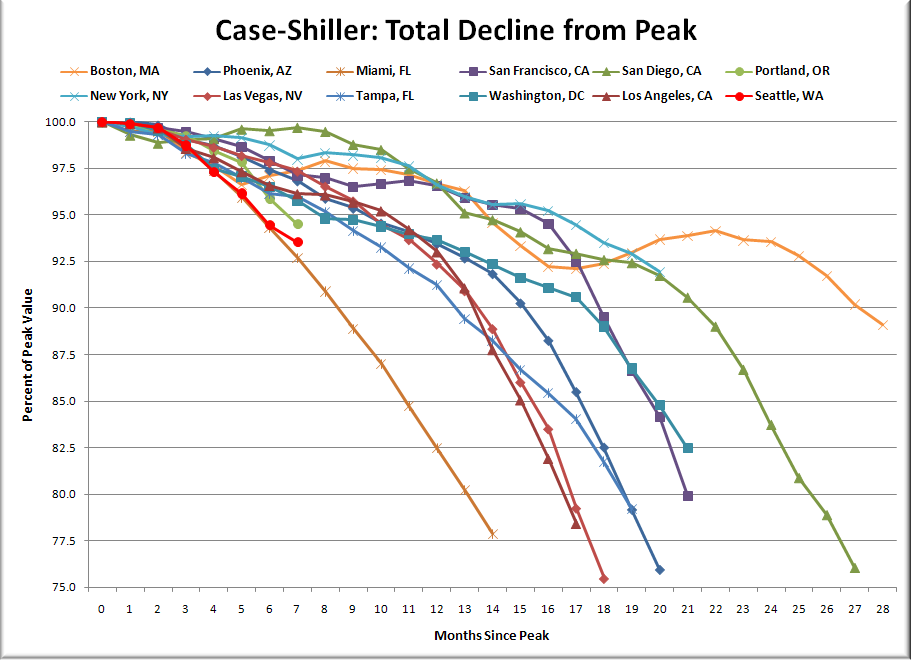

Yes I know. We always agree. 8]

Do you really believe any of those buyers didn't know they were gambling that something would change over time to make refinancing to a regular loan more palatable?

My analogy holds to the leverage being used before the great depression. They were using this type of financing as a lever to buy more house than they could afford gambling that they could afford it later and reap the rewards of the appreciation on a nicer house than they could afford.

The case for the state getting involved includes, I believe, that this type of financing is part of the reason prices could inflate beyond what the market truly could bear.

|

|

| | | 12 | Perm Dude

ID: 19758307

Thu, Aug 30, 2007, 14:10

|

Well, the word "any" is a very tough standard to meet. The role of the broker would be to minimize such risky thoughts, sometimes by lying.

|

|

| | | 13 | biliruben

ID: 17502215

Thu, Aug 30, 2007, 14:39

|

Absolutely, Baldwin. I've been railing against flipers, "investers" and speculators for the last 3 years.

There was certainly some of that - maybe as much as 15-20% of the market in some of the bubbly regions.

They couldn't have done it without the financing, however.

|

|

| | | 14 | nerveclinic

ID: 105222

Thu, Aug 30, 2007, 14:51

|

Someone correct me if I am wrong. As long as you were in good financial shape, ARM's were a smart move when interest rates were falling, and when the rates were down low.

With a couple caveats.

They were smart as long as...you were allowed to refinance at any time with no prepayment penalty. You also had to be financially sound enough to afford the new "normal" 15 or 30 year loan once it became obvious that rates were going to rise. To put it another way, you should have been able to afford the 15-30 year loan from the start, but only be using the ARM for the additional 1.5 or 2% interest rate you could save.

In other words, you took the ARM solely to get an extremely low rate, not because it was the only payment you could afford.

Fed raising of interest rates are very easy to predict in this day and age with the financial experts having an incredible success rate in forecasting.

The problem isn't really ARMS. It people who used them (And sold them) because it is the only monthly payment they could afford. Or it was bought by people not savvy enough to notice when virtually everyone is saying "interest rates are about to go up, refinance and lock in".

My God if you are a smart investor ARMS would have been an intelligent 3 year investment and at the end you could have locked in a 15-30 year rate at the bottom.

It was almost a free loan for some people after tax deductions.

|

|

| | | 15 | Perm Dude

ID: 19758307

Thu, Aug 30, 2007, 15:03

|

It was also a smart move so long as the market remained pretty much a "seller's market" (which, of course, were tied closely with the interest rates.

Many ARM holders had no intention of holding the loan through its life. If they could build equity they could just pay off the loan (prepayment penalty included) to buy up, so long as demand kept housing prices going up.

|

|

| | | 16 | biliruben

ID: 17502215

Thu, Aug 30, 2007, 15:08

|

You aren't wrong.

I have an ARM, and other than a slight niggling worry that I will have trouble selling my house when I try in a few years, I don't regret it.

My estimate was that I would save about 8 grand over the 7 six years (max) I planned to live there. 8 gs is 8 gs.

My only worry is that I won't be able to sell, but I don't count that as a real possibility. I have over 50% equity in it now, so even if I have to slash the price, I can.

And even after the max adjustment (can go from 5% to 10%), we are still fine with the payment; it's even manageable on 1 income if we are really unlucky.

But I think you are right. In many markets people were being approved based on their ability to pay just the teaser. 2/28s with a hard pre-pay penalty could sometimes put 15K right into the broker's pocket. That's a pretty big incentive to screw the borrower.

|

|

| | | 17 | nerveclinic

ID: 105222

Thu, Aug 30, 2007, 15:10

|

Many ARM holders had no intention of holding the loan through its life. If they could build equity they could just pay off the loan (prepayment penalty included) to buy up, so long as demand kept housing prices going up.

But that is speculating and has nothing to do with the homeowner I described above.

|

|

| | | 18 | Perm Dude

ID: 19758307

Thu, Aug 30, 2007, 15:14

|

Well, sure, nerve. The smart investor type could have used it in that way, provided that the ARM worked that way.

But with rising housing prices, most smart investors would have been looking to flip first, rather than hunker down on a low rate.

|

|

| | | 19 | nerveclinic

ID: 105222

Thu, Aug 30, 2007, 15:49

|

Right but I was simply talking about a typical home buyer who could afford the property they were buying...not someone who was in it to "flip".

|

|

| | | 20 | nerveclinic

ID: 105222

Thu, Aug 30, 2007, 16:55

|

Billi 16...you are probably going to get another break before the end of the year from the FED.

Why didn't you lock in when rates were low? Did you calculate the rates would have to go up ALOT before the rate would be "bad?"

I don't think you have a lot to worry about anyway. You're in a great market. You bought a mid price home, very affordable. That's the kind of house people will be looking for when they can't afford their over priced mansions.

|

|

| | | 21 | Baldwin

ID: 125312919

Thu, Aug 30, 2007, 17:04

|

I think there were a lot of people unrealistically depending on natural carreer path income adjustments [between 2 income earners surely someone would get a raise], paying down debt that really wouldn't happen before balloon payments and conversion to standard loan format were due, wishful thinking that inflation rates would forever be kept in check by the Fed [they have been doing remarkably well since Reagan took office].

|

|

| | | 22 | biliruben

ID: 17502215

Thu, Aug 30, 2007, 17:05

|

I thought about locking last year when the fixed rates dropped below 6, but given that we are certainly going to move before we see it adjust in 2011, the transaction costs weren't worth it for just a little piece of mind.

5% is 5%, and it will be that way until we move to a bigger house.

|

|

| | | 23 | nerveclinic

ID: 105222

Fri, Aug 31, 2007, 06:41

|

5% is 5%, and it will be that way until we move to a bigger house.

Oh wow that's incredible. You have that rate until 2011??? I don't think you have a thing to worry about. Even if the housing market worsens, that pretty much assures rate will go down not up and you'll have the chance to lock in close to that rate anyway.

There's no way housing in Seattle stays bad through 2011. Too many Californians who can't afford their houses want to move there.

Bili if you have 5% until 2011 I think you made a brilliant move.

|

|

| | | 24 | biliruben

ID: 17502215

Fri, Aug 31, 2007, 15:46

|

Bush's subprime plan, interpreted:

1. Immediate FHA assistance for people who are already 90 days down. Does this mean "up to 90 days down," "at least 90 days down," or what? Waiting to offer refi assistance until borrowers are in the foreclosure process isn't likely to make them want to go find the friendly neighborhood loan officer to do an FHA refinance. And by then, they've got a big chunk of past-due payments (not to mention possibly a prepayment penalty) to roll into the new loan. However,

2. We can't offer more proactive assistance to those who look like they're ready to default but haven't gotten there yet, because apparently after all this time we still need some more task forces. I'm guessing that we're still working on how the "more favorable rates" become available when the FHA insurance premium has to be raised and investors aren't exactly crushing each other in the rush to buy these loans.

3. But if you've already lost your home to foreclosure or short sale, you might get a tax break. This will "keep people in their homes" by making it less expensive for them to give up their homes. Or something.

|

|

| | |

| | | 26 | biliruben

ID: 17502215

Wed, Sep 05, 2007, 17:40

|

The Economist: Heading for the Rocks

⢠Scenario 1. The Economist Intelligence UnitÂs central forecast, to which we

attach a probability of 60%, sees the impact being contained by timely monetary

policy action, with only a modest effect on the global economy.

⢠Scenario 2. Our main risk scenario, with a 30% probability, envisages the

US falling into recession, with substantial fallout in the rest of the world.

⢠Scenario 3. Should the US enter recession, another, darker scenario arises:

that corrective action fails, and severe economic repercussions cascade from the

US into the world economy with devastating effect. We attach only a 10%

probability to this outcome, but the potential impact is so severe that it warrants

careful consideration.

|

|

| | | 27 | nerveclinic

ID: 105222

Wed, Sep 05, 2007, 18:48

|

Bili you're publishing a positive outlook?

That's not like you.

This report gives a 60% odds of a positive outcome.

I thought the sky was falling?

8-}

By the way...did U pay for this report?

|

|

| | | 28 | biliruben

ID: 17502215

Wed, Sep 05, 2007, 18:57

|

No, it's free, right? Can't you see it?

It spends the most time on Scenario 2, and anyway, I didn't say I agreed with it. ;)

I assume they just don't want to look too kooky, and I suspect, given the content, that they think Scenario 2 is more like 50%.

|

|

| | | 29 | boikin

ID: 59831214

Thu, Sep 06, 2007, 13:17

|

I just finished reading most of the of article, as allways the economist published interesting material. i find it interesting that the only really bad scenario is 3. scenario 2 is more of a short term economic slow down. which is probably a good thing i would think in the long term. I personally have no idea how it is all going to play out but i doubt my banker friend is correct when he believes his more senior bankers that that the houseing market will be back to normal by mid 2008 at the latest and this is in an area where the mediam house price probably rose about 400% in 10 years while income has stayed relitivy in line with inflation.

I am more worried about any govermental bail outs, there is no logical reason that i can see for bailing out people that made bad choices, call economic darwinism. No one is holding a gun to these peoples heads and telling them to buy the house, yes there where problaby some lenders that were like we will do what ever it takes to get you in that home, but the fact of matter is you have to be resposible for you own decisions. As for the corporations and what not that bought up the debt form the sub prime morgages they knew the risks. The ironic thing is that i would not be surprised that if 10 years down the road the people who bought up the the debt will make a fortune.

|

|

| | | 30 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 13:24

|

When they are lied to, however, that should be a different story. You assume that the decisions were made with all the facts presented, but that isn't the case.

|

|

| | | 31 | boikin

ID: 59831214

Thu, Sep 06, 2007, 13:29

|

if you are lied to that is fraud and i think they should just sue and or have them arrested and any ways I really doubt that the percent of people that were lied too is that high. I would like to see an example of how they were lied too.

|

|

| | | 32 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 13:33

|

You mean besides my example above?

There's no disincentive for these people not to lie, and there is loads and loads of money involved.

|

|

| | | 33 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 13:35

|

We also need to keep in mind that the government washing their hands of it will send a signal to many markets that the numbers will get worst, not better, and in financial markets (driven by perception more than anything else), this means additional losses for American companies and investers.

|

|

| | | 34 | biliruben

ID: 17502215

Thu, Sep 06, 2007, 13:49

|

They attach an inordinate, imho, amount of faith in the central bankers. Unfortunately the central bankers are pretty much 1-trick ponies. They can raise and lower rates that traditional banks use to lend each other money. Unfortunately it's not the traditional banks that are in the midst of this crisis.

The hope, and there appears to be some evidence that this is happening over the last week, is that the ineffectual action will have a positive, confidence-inspiring psychological lift, preserving the illusion of control. If it works, great.

If it doesn't however, then it may be much worse than if the central banks and done nothing at all, as they will be exposed as impotent as the Great and Powerful Oz.

As for governmental bail-outs, I'm not sure that's what we are seeing proposed.

I think there were plenty of evil-doers that perpetuated, profiteered and exacerbated the bubble in all camps: borrowers, lenders, Realtors(tm), rating agencies, wall-street, main-street, backstreet boys, back-biters, nail-biters, nail-gun wielders, white-gold wielders, gold-bugs, bed-bugs, bed salesmen, car salesmen, fantasy salesmen and fantasy baseball players. All of 'em.

There are also some relatively innocent and unknowledgeable people who relied upon professionals to guide them through different aspects of this terrain, but were duped and robbed. These people run the gambit from the high-school dropout who bought a house with a tricksy loan in inner-city Cleveland go through bankruptcy all the way up to the nuclear physicist who trusted his financial adviser to invest his million in the "safe" Hedgefund invested in CDOs returning 12% a year, and lost everything.

I am apt to see if we can help the high school graduate find a loan he can afford to stay in his house, but I would hope we could find a way to pay for it through the folks who made trillions over the last 10 years peddling faux-dreams for profit. I dang well don't want any corporate bail-outs.

|

|

| | | 35 | boikin

ID: 59831214

Thu, Sep 06, 2007, 13:51

|

PD i am sorry i can find the example can you post the thread #?

We also need to keep in mind that the government washing their hands of it will send a signal to many markets that the numbers will get worst, not better, and in financial markets (driven by perception more than anything else), this means additional losses for American companies and investers.

so you are saying that if the government does nothing then the country will beleive that things are going to get worse? i would see it the other way around the government doing something tells me that something bad is about too or did happen and now they are trying to save us. I am not sure the government doing anything or nothing really sends anykind of message.

|

|

| | | 36 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 14:05

|

I think people are already worried and are looking for the government to do something (even if it is to clamp down on lying brokers).

They want to know that the government takes seriously the threat of thousands of defaulting mortgages, particularly since many of those mortgages were bought up and are part of retirement accounts.

This has the makings of more than just a re-adjustment of the stock market, I think.

My own example was in the last thread: The refi broker told up on the phone there would be no prepayment penalty, so we never looked for one in the document. Lo and behold, a prepayment penalty! This means that we have to keep the price of our house just that much higher in order to pay off the mortgage. The penalty for lying to us? Nothing.

|

|

| | | 37 | boikin

ID: 59831214

Thu, Sep 06, 2007, 14:30

|

Ill agree with you that the government should be cracking down dishonest/lieing brokers. though i think that if i am going to be putting out this much money for that long of time i am reading every word of that paper multiple times and probably giving it to friend to read over too. Also if i am buying home i looking at it like i may have to live here for ever what are the consequences and if i have to sell it i may lose money.

You may be right this could lead to an all out disaster, but i highly doubt it. there is still tons of money out there why do you think the stock market has been up in the past year? Because investors have been moving money from the realestate back to market just as they did the opposite in 2000.

|

|

| | | 38 | biliruben

ID: 17502215

Thu, Sep 06, 2007, 14:53

|

...i think that if i am going to be putting out this much money for that long of time i am reading every word of that paper multiple times and probably giving it to friend to read over too.

I agree wholeheartedly.

Unfortunately you don't see the documents (and a flurry of 100 other documents) until they day of the signing.

That's part of the problem.

And the guy who lied to PD? He knew he couldn't possibly spend the time on the document that he should, because they don't give him that time.

And Wall Street told him in so many words: "if you sneak in a pre-pay penalty in that document and PD misses it, we will give you $15,000."

That is a lot of jack to bend your ethics, and many unscrupulous brokers made a lot of money doing just that.

|

|

| | | 39 | boikin

ID: 59831214

Thu, Sep 06, 2007, 15:47

|

Ill agree that is pretty unethical but i see no evidence that means there needs to be a bail out. you send those lenders to jail and/or fine them and allow the lendies out of the terms of the mortgage allow them to renegotiated with out fee. But for me to believe that the whole mortgage issue was cause by unscrupulous brokers is ridiculous.

|

|

| | | 40 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 15:50

|

You think thousands of really dumb people suddenly decided to buy houses? I'm only being a little sarcastic--a whole bunch of people who never used to be able to get mortgages are suddenly homeowners. How do you think they got there? By not reading contracts?

In the past, these people would have never seen contracts to overlook clauses from.

|

|

| | | 41 | biliruben

ID: 17502215

Thu, Sep 06, 2007, 15:56

|

. But for me to believe that the whole mortgage issue was cause by unscrupulous brokers is ridiculous.

Why would you believe that? I certainly don't.

They were just one unscrupulous cog in a whole massive (and I mean massive), lending machine.

I repeat:

I think there were plenty of evil-doers that perpetuated, profiteered and exacerbated the bubble in all camps: borrowers, lenders, Realtors(tm), rating agencies, wall-street, main-street, backstreet boys, back-biters, nail-biters, nail-gun wielders, white-gold wielders, gold-bugs, bed-bugs, bed salesmen, car salesmen, fantasy salesmen and fantasy baseball players. All of 'em.

Personally, I think the boikins of the world were the most to blame, because of bad fantasy trades.

|

|

| | | 42 | boikin

ID: 59831214

Thu, Sep 06, 2007, 15:58

|

PD you really underestimate both greed and stupidity. If some offers to sell me there new BMW for 10K, i laugh and walk away i dont say where do i sign.

|

|

| | | 43 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 16:04

|

PD you really underestimate both greed and stupidity.

Nonsense, I'm just placing it where it belongs: The brokers got greedy and stupid. The demand is always going to be high for unqualified people to get houses. The difference is that the financial markets lowered their standards and started to lie to people to pave their own pockets with fees.

To take your example: There will always be a demand for $10K Beemers, but when brokers start selling them by telling people they don't have to even put any money down, or that they can sell the car in a year for a huge profit, then that is a problem in the supply side, not the demand side.

|

|

| | | 44 | boikin

ID: 59831214

Thu, Sep 06, 2007, 16:25

|

First off people should not be buying houses or cars on assumption they are going to make a huge profit in the next year that is just plane stupid and i would say most people thinking that did not need the broker to tell them that in first place. so basically you are saying we should reward the stupid by bailing them out, maybe you would like the government to bail out all the people that lost money in the dot coms, while you are at it.

|

|

| | | 45 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 16:32

|

so basically you are saying we should reward the stupid

Uh, no, not at all. What I'm saying is that these people were suckered. You can call them "stupid" but the truth is that they relied on promises and offers made by the broker. Did the "stupid" tell the brokers to lie to them? Did the "stupid" tell the brokers to offer them unsustainable mortgages, to lower their standards for acceptance, or to even come up with subprime loans in the first place? Pretty smart "stupid" people, if so.

Were the banks and brokers forced to offer the mortgages? Or to lie, for that matter? So why let them off the hook completely, as though the other party (often with no homebuying experience at all) is the "stupid" one?

First-time homebuyers might be "stupid" (or might not) but they trust what their broker says as being the truth.

Of course, since you don't know what my suggestions are to fix this, your whole premise kind of falls apart, IMO.

|

|

| | | 46 | katietx

ID: 58838612

Thu, Sep 06, 2007, 16:34

|

Being in the banking biz and doing equity loans, I can assure you that people DO NOT read contracts.

Preliminary documents are given prior to closing and most folks do not have a freakin' clue what they say - nor are they going to take the time to read them. We are required by law to actually READ some document verbatim - people just zone out - don't hear a damn thing.

|

|

| | | 47 | Perm Dude

ID: 46827610

Thu, Sep 06, 2007, 16:41

|

That's because they are looking at your tat...

|

|

| | | 48 | boikin

ID: 59831214

Thu, Sep 06, 2007, 16:42

|

PD i guess i am the stupid one here cause in my mind the concept of signing a morgage that comes any where close to unsustainable is pretty scary. Just with the BMW example i used, if think things sound too good i am the first one to walk away. I guess i just assume that everyone is as untrusting as me.

I will say this that they should probably educate first time buyers better, though in many cases these people were not first time buyers they were people buying investment properties and second homes.

|

|

| | | 49 | katietx

ID: 58838612

Thu, Sep 06, 2007, 16:54

|

ROFL - um no they're not. Unfortunately in the conservative banking world (even in Austin) the tats cannot show. *sigh*

|

|

| | | 50 | biliruben

ID: 17502215

Thu, Sep 06, 2007, 17:45

|

Boikin - in some circumstances you are right.

There were certainly people stretching themselves, realizing they could not pay the fully amortized amount, essentially gambling that:

1) Their situation would improve by the time it would reset, or

2) Houses would continue to appreciate, and they could refinance by the time the arm reset.

The second option is what they were hearing from both "the professionals", their Realtor(tm) and their broker, as well as from their friends who had been doing just that for the last 10 years, and had made out just fine doing it.

The Realtor(tm) and the broker had strong self-interest to perpetuate this fantasy. The Realtor(tm) doesn't get paid until the deal closes and the broker is guaranteed a repeat customer a year or 3 down the road with the refinance to make another 15 gs.

The friends were blinded by a period of unprecedented and historic housing appreciation. When you see your house appreciate double digits, and your paper profits are hundreds of thousands of dollars on only a few thousand or sometimes nothing down, you want to brag about it and tell your friends about this "awesome deal"!

And it really worked. That's the thing. If you bought a house in the right area in the late 1990s for 200K with 40K down, that 40K turned into half a million dollars! What other investment returns more than 10 times your money in less than a decade.

That's sweet, juicy, Jesus-money, that is.

You are going to try and replicate it, and you are going to tell everyone you know and like to do the same.

But there are those who were also just plain didn't know any better, just wanted a house, and trusted their mortgage broker to understand the intricate and extremely baffling (to some) mine field of home and mortgage finance. Many of those were simply bamboozled; and often legally.

Those people should be helped, and as much as possible on the broker's dime.

|

|

| | | 51 | nerveclinic

ID: 105222

Fri, Sep 07, 2007, 07:37

|

They attach an inordinate, imho, amount of faith in the central bankers. Unfortunately the central bankers are pretty much 1-trick ponies. They can raise and lower rates that traditional banks use to lend each other money.

Well for one trick that's a pretty good one.

Unfortunately it's not the traditional banks that are in the midst of this crisis.

The hope, and there appears to be some evidence that this is happening over the last week, is that the ineffectual action will have a positive, confidence-inspiring psychological lift, preserving the illusion of control. If it works, great.

Actually to an extent the traditional banks are getting caught up because there's been an overall loss of liquidity in the total credit market due to the sub prime mess.

The "illusion of control" is to make sure that banks have liquidity to go about their normal business. That's a pretty good illusion.

If it doesn't however, then it may be much worse than if the central banks and done nothing at all, as they will be exposed as impotent as the Great and Powerful Oz.

What is it you expect them to do to meet your criteria of being successful? They aren't going to help people who took bad loans.

The Fed has already stated it's not their job or intention to use rate drops to help people keep a house who made a bad investment.

The rates were dropped because there was a lack of credit liquidity in the market for other investment and financial purposes. Good investors and banks were getting caught up in the sub prime mess. That's who the Fed is trying to help.

That doesn't mean that if this house of cards continues to crumble (subprime mess), and people lose there houses, the Fed is ineffectual.

The measure will be how does the economy that is not connected to the sub prime hold up. That is who the Fed is trying to help.

IMHO the Fed could care a less about someone who bought a house who shouldn't of been able to afford it, nor do they care about lenders who made stupid loans and Bernake has pretty much said just that.

So far everything is working fine (Housing aside and come on we all have known for years it was a bubble).

The early August numbers that have come in look surprisingly good so far, in fact part of the reason for the drop in the market Wednesday is because the beige book report for August came in better then expected and investors are worried that the Fed will not cut rates at the September meeting because the economy is doing to good.

|

|

| | | 52 | nerveclinic

ID: 105222

Fri, Sep 07, 2007, 07:47

|

And the guy who lied to PD? He knew he couldn't possibly spend the time on the document that he should, because they don't give him that time.

Bili sorry but that is just flat out wrong. You have every right to read every word on the documents your signing. No one has the right to tell you, you can't read the document.

I have no doubt there are realtor's who try to intimidate you, and use psychology to get you to skip reading the document, but that doesn't mean they can force you to sign without giving you the time to read it.

Many, many, many people bring lawyers to the signing and you better believe the lawyer reads every word. If I had a Realtor tell me I couldn't read the contract I would get up and walk out of the room and tell them to call me when they have time to let me read it.

It wouldn't be me telling them that though it would be my lawyer because I wouldn't spend hundreds of thousands of dollars without a lawyer looking at it, but that's just me.

Do you think they are going to tell a lawyer they don't have time for him to read the document?

|

|

| | | 53 | nerveclinic

ID: 105222

Fri, Sep 07, 2007, 07:53

|

Katie Being in the banking biz and doing equity loans, I can assure you that people DO NOT read contracts.

Preliminary documents are given prior to closing and most folks do not have a freakin' clue what they say - nor are they going to take the time to read them. We are required by law to actually READ some document verbatim - people just zone out - don't hear a damn thing.

Katie I believe you but that just blows my mind.

Frankly if that is the attitude someone takes when investing hundreds of thousands of dollars, it's hard to feel too sorry for them when the investment goes bad.

|

|

| | | 54 | Perm Dude

ID: 1481279

Fri, Sep 07, 2007, 10:18

|

It is all part of the psychology being employed (and remember, the broker is in a position of trust). They throw lots of documents at you at the last minute and rush you through it.

pd

|

|

| | | 55 | Perm Dude

ID: 1481279

Fri, Sep 07, 2007, 10:19

|

I meant to add that the buyer & seller should have draft paperwork no later than 24 hours before closing, IMO. Would love to see that proposed.

|

|

| | | 56 | nerveclinic

ID: 105222

Fri, Sep 07, 2007, 10:40

|

(and remember, the broker is in a position of trust)

Actually I've always heard the opposite.

I've heard that even though the broker is "working for you", they are really working for the seller because that's who pays the commission.

In the end, what difference does it make to the broker what kind of a deal you get? If you pay less for the house, they get a smaller commission. If you read the fine print and don't like the contract and the deal falls through, they don't get a commission.

I've always been told the only one you can trust at a closing is your lawyer.

But as you've already pointed out about me PD I am a cynic at heart. I go into every business situation trusting no one, and when someone is fair with me I am pleasantly surprised.'

|

|

| | | 57 | sarge33rd

ID: 99331714

Fri, Sep 07, 2007, 10:43

|

Closing on the scheduled closing date would also be helpful. When we bought our house in Sioux City, the closing as I recall was rescheduled twice. Then finally executed something like 72 hrs before we had to be out of where we had been living. So here we were, looking at a stack of docs 6" thick, having to move the entire household, still having to go to work every day, having to prep the new place so we could occupy it, etc etc etc.

I am not saying that we were amongst those hoodwinked. We weren't. But I have no doubt, there are more than a few hundred similar scenarios across the country, where the rescheduling of the closing repeatedly, was used as a tool. Jam the buuyer for time, get them frustrated, keep them off balance, then at the last second when they have 3,000 different tasks on their minds, tell them, "sign here, here, here and here and it's all done finally."

I REALLY like PD, oyur suggestion of draft paperwork being provided. But I'd like to see it with a 7 day requirement, so that one has ample time for an atty to properly review it. Getting it at noon Thurs with a noon Fri slated closing, doesnt necessarily give ones atty the time he/she will need to properly review the docs and then go over it with you their client.

|

|

| | | 58 | Perm Dude

ID: 1481279

Fri, Sep 07, 2007, 11:43

|

I've heard that even though the broker is "working for you", they are really working for the seller because that's who pays the commission.

The mortgage broker is working for the buyer, not the seller. The seller isn't getting a mortgage and would not need the services of a mortgage broker. Put another way, on a cash deal there would be no mortgage broker even though there is still a seller.

The broker fee is typically folded into the "closing costs," the buyer's portion of which are themselves typically (not always, but usually) part of the loan. Stuff like inspection fees, any mortgage costs, and so on.

On a re-fi, the broker is working for the homeowner and there is no other party involved (other then the lender, of course).

|

|

| | | 59 | nerveclinic

ID: 105222

Fri, Sep 07, 2007, 11:57

|

PD I was getting broker confused with a realtor.

In the end though, isn't the mortgage broker just "selling" you something (a mortgage)? Isn't that like saying a car dealer is working for you since he's selling you a car?

|

|

| | | 60 | Perm Dude

ID: 1481279

Fri, Sep 07, 2007, 12:11

|

The broker is supposed to act on your behalf in getting you the best deal with the various banks, loans, and loan companies. But that is compromised (as bili notes many times) by the fact that his fee is typically a kickback from the companies he's selling the services of.

In stocks (as you know), this kind of conflict of interest has been attacked through legislation. But mortgage brokers don't have the wall of separation that other financial professionals have between their fees and the products they are negotiating for on behalf of the mortgage buyer.

|

|

| | | 61 | biliruben

ID: 17502215

Fri, Sep 07, 2007, 13:46

|

Yes, Nerve. I understand what YOU would, theoretically, do.

As I've stated before, however, you are in the vast, vast, vast minority in this circumstance. It eagerly await your first home purchase, so your superiority can be put to the test.

I agree that a lawyer can be prudent, but there are also some disadvantages if he takes an antagonistic attitude towards the agents or broker. I've heard stories of them doing more harm than good and actually losing the client the house and/or costing them money.

There are times when you have to show at least a modicum of trust to get anything accomplished in this world.

|

|

| | | 62 | nerveclinic

ID: 105222

Fri, Sep 07, 2007, 14:05

|

It eagerly await your first home purchase

Don't hold your breath, it's not really something I've ever wanted to do.

|

|

| | | 63 | biliruben

ID: 17502215

Fri, Sep 07, 2007, 14:25

|

You are wicked shmaaaatt. ;)

I thought similarly until confronted with a wife, kid, 4 cats and a big dog! Try squeezing all that into an apartment. It was a bit chaotic for a while there.

I even searched pretty extensively for an house to rent before buying that would be similar rent to a mortgage payment. No dice, even if I could talk 'em into all the critters.

In 2007 things are probably different, but that was the state of things in 2004, pre-50% appreciation on everything within 100 miles of the space-needle.

Now renting would be cheaper, I'm sure.

|

|

| | | 64 | nerveclinic

ID: 105222

Fri, Sep 07, 2007, 17:52

|

Bili if I had a wife and a kid I would buy a house.

clearly I'm mobile. In the last 5 years I've lived in Seattle, Los Angeles, San Francisco and now Dubai.

People who bought homes 7-8 years ago are still looking really smart, they've cleaned up.

Even here I could easily buy a condo in a high rise for under 200K right now, not bad considering my one bedroom apartment is 20K a year and that's cheap. Might be a good investment, might not.

It's just never been my dream to own property in the middle east 8-} ...although Dubai is the middle east like San Francisco is Iowa. (sorry Sarge, or was it Idaho?)

You are one lucky house owner to live in one of the only housing markets in the country that is still hanging in there.

|

|

| | | 65 | biliruben

ID: 17502215

Fri, Sep 07, 2007, 18:00

|

So far.

Seattle-proper only had 1.8% YOY appreciation in July, and August numbers are suspiciously tardy.

The Bellevue/Redmond is the main propping up the market right now. Microsofties still getting into bidding wars. 'Tupid money.

|

|

| | | 66 | biliruben

ID: 4911361723

Tue, Sep 11, 2007, 11:43

|

Great Stuff from Congressman Ackerman!

Originators then took these loans â many of which should have been assessed as much riskier than they were â and packaged them into securities to sell to investors. If there had been full disclosure, smart and careful investors would have judged that these mortgage backed bonds carried a disproportionately high level of risk. In an effort to deliberately mislead investors, however, some originators and credit-rating agencies, so-called Nationally Recognized Statistical Rating Organizations (NRSROs), colluded. First, the credit-rating firms would consult, or maybe we should say collaborate, with the originators â receiving high fees, of course â to advise the originators how to design the packaged securities to ensure that the riskiest piece of the product was adequately masked. Then, for another fee, the credit raters would assign overly favorable ratings to these mortgage-backed bonds, giving investors the impression that a neutral, unbiased party with a proven track record of assessing risk thought highly of these volatile products.

Essentially, the originators and credit raters shoved enough pigs and laying hens in with the beef herd that investors expecting prime ribs on their silver platter and money in their pocket ended up with pork ribs on their paper plate and egg on their face. The credit-rating firms were double-dipping; profiting first from helping to put these shady securities together, and then collecting fees for deliberately rating these risky products at a higher value than they were worth. Itâs like hiring a judge to advise you as to how to commit an act and then paying him to decide whether you have committed a crime. My strong view is that NRSROs conspired with financial institutions to fool investors by packaging and rating securitizations in a manner that was deliberately aimed at misleading them. This is the accounting firm telling shareholder companies how to fool their investors and then getting hired as independent auditors.

That's not the free market at work. That's fraud. Fraud is a crime, not a correction.

I'm don't know if I would blame this all on the ratings agencies, though they certainly deserve a share. However, I do like his tortured metaphor very much!

|

|

| | | 67 | nerveclinic

ID: 105222

Tue, Sep 11, 2007, 17:51

|

That's not the free market at work. That's fraud. Fraud is a crime, not a correction.

Right but that is only one small part of the story. The other Bigger part is that interest rates were extremely low and this caused monthly house payments to be lower for a particular piece of property. Therefore the price of properties appreciated more then they were logically worth.

Then on top of that people were sold mortgages that were not fixed rates and were destined to go up dramatically when rates inevitably rose.

That's the bubble. It would have happened even without the scenario described above.

|

|

| | | 68 | biliruben

ID: 17502215

Tue, Sep 11, 2007, 18:07

|

I agree for the most part, Nerve, but when you say...

Then on top of that people were sold mortgages that were not fixed rates and were destined to go up dramatically when rates inevitably rose.

...would have happened, I'm not so sure that's true. Certainly not to the extent it did, because the rating agencies were complicit in providing sucke.., er, buyers/investors for those dubious mortgages.

Before the securitization craze, banks would generally hold onto these things themselves, and therefore they were much more picky about who they would lend money to. Over the last few years, it was "Have a pulse? Have a mortgage!", because rating agencies and had convinced investors that through securitization you could slice and dice the risk away. Utter nonesense, but a lot of folks bought these things who normally wouldn't have.

|

|

| | | 69 | nerveclinic

ID: 105222

Wed, Sep 12, 2007, 05:07

|

Certainly not to the extent it did, because the rating agencies were complicit in providing sucke.., er, buyers/investors for those dubious mortgages.

Yeah and this is the part of the story that may actually result in prosecutions. There's some people who incorrectly rated these investments and it's becoming clear the deception was probably intentional.

Now these are some big time investors they are deceiving. It's their job (Moody's and SP) to rate correctly and honestly. If there was intentional inaccurate ratings some heads are going to roll.

|

|

| | | 70 | biliruben

ID: 17502215

Wed, Sep 12, 2007, 13:45

|

I don't really care whether heads will roll or not. I just want to somehow get the folks who made trillions in lucrative fees and bonuses during the run-up to pay for softening the blow of the looming abyss.

I won't hold my breath.

|

|

| | | 71 | Baldwin

ID: 125312919

Wed, Sep 12, 2007, 14:20

|

This thread...or series of threads...has got to rank as some of our best work.

|

|

| | | 72 | nerveclinic

ID: 105222

Thu, Sep 13, 2007, 09:42

|

This thread...or series of threads...has got to rank as some of our best work.

I went back to the first thread. You started it on December 09, 2004 Baldwin.

|

|

| | | 73 | Perm Dude

ID: 35848138

Thu, Sep 13, 2007, 09:49

|

Was just kicking some ideas around in my head this morning in the shower. Yeah, I know, I'm a geek. But I wonder if anyone has proposed some kind of broker commission reserve for mortgages sold as subprime? In other words, to hold back, say, 80% of a commission as a reserve, then pay it out 25% each year that the loan is still good. If the loan defaults, the remainder of the commission in reserve is forfeited, maybe to the borrower who paid it in the first place (or, in the case of no-down loans, to some other entity).

Book publishers do this all the time. It is called a "reserve against return" and typically would last only the first couple of years after a book's publication.

Just kicking this around...

|

|

| | | 74 | biliruben

ID: 4911361723

Thu, Sep 13, 2007, 11:40

|

Sounds reasonable to me, but I'm sure the brokers, their lobbyists or the congressmen in their pockets probably don't think so.

|

|

| | | 75 | boikin

ID: 59831214

Thu, Sep 13, 2007, 11:54

|

That does sound like a good idea PD and i am sure the lender of the money would like this idea sense this would probably decrease the chances that they took on a bad loan.

|

|

| | |

| | | 77 | biliruben

ID: 17502215

Thu, Sep 13, 2007, 15:31

|

We have the freedom to cuss now?

|

|

| | | 78 | biliruben

ID: 17502215

Thu, Sep 13, 2007, 15:47

|

Back in February, 2004...

"American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage," Greenspan said.

...and in the upcoming interview on 60 minutes:

While I was aware a lot of these practices were going on, I had no notion of how significant they had become until very late, he tells Stahl. I really didnt get it until very late in 2005 and 2006.

...and last fall:

Oct. 6 (Bloomberg) -- Former Federal Reserve Chairman Alan Greenspan said the ``worst may well be over'' for the U.S. housing industry that's suffering its worst downturn in more than a decade.

Greenspan, speaking at a conference in Calgary today, pointed to a ``flattening out'' of weekly mortgage applications after they went down ``very dramatically.''

Dude's either senile or bought and paid for.

|

|

| | | 79 | biliruben

ID: 17502215

Fri, Sep 14, 2007, 12:09

|

It's not just in Cali anymore.

Another bank run, this time in London.

Hundreds of Northern Rock Plc customers crowded into branches in London today to pull out their savings after the mortgage-loan provider sought emergency funding from the Bank of England ...

This, after the bank of England came out with a statement the previous day saying they wouldn't bail out banks with large infusions of liquidity:

In a letter to McFall's committee on Wednesday, BoE Governor Mervyn King warned that providing short-term liquidity to the financial markets while they were experiencing trouble served to encourage "excessive risk-taking and sows the seeds of a future financial crisis".

"The provision of large liquidity facilities penalises those financial institutions that sat out the dance, encourages herd behaviour and increases the intensity of future crises."

WTF?

|

|

| | |

| | | 81 | Perm Dude

ID: 39858209

Thu, Sep 20, 2007, 14:42

|

Spring 08 is going to be a tough couple of months for housing. I'm guessing that realtors' phones are going to start ringing off the hook in January & February as people try to squirm out of their ARM sub-prime mortgages.

|

|

| | |

| | | 83 | biliruben

ID: 17502215

Fri, Sep 21, 2007, 15:31

|

Just make it a credit, or better yet; do away with it entirely.

|

|

| | | 84 | Perm Dude

ID: 7822111

Fri, Sep 21, 2007, 15:52

|

That's what Barack Obama proposed recently, though it seems to me to be kind of tiny.

I'll create a mortgage interest credit so that both itemizers and non-itemizers get a break. This will immediately benefit 10 million homeowners in America. The vast majority of these are folks who make under $50,000 per year, who will get a break of 10 percent of their mortgage interest rate. For most middle class families, this will add up to about $500 each year. This credit will also extend a hand to many of the millions of Americans who are stuck in the subprime crisis by giving them some breathing room to refinance or sell their homes.

I suppose this is in lieu of the current deduction. And I think he means "10 percent of their mortgage interest costs" rather than interest rate, but it's clear what he's trying to say.

|

|

| | | 85 | biliruben

ID: 17502215

Fri, Sep 21, 2007, 17:08

|

10 percent of your interest as a credit, and cap it at the conforming level (currently 417K), and I might go along. Anyone paying a jumbo doesn't need any tax credits, but I'll give them up to 417K for political expedience.

|

|

| | | 86 | nerveclinic

ID: 105222

Fri, Sep 21, 2007, 19:01

|

I just talked to my friend who works for country wide, been there 5+ years...he's looking at a layoff next week.

2 kids, wife, big mortgage.

|

|

| | | 87 | biliruben

ID: 17502215

Fri, Sep 21, 2007, 19:45

|

There are going to be an increasing number of extremely sad stories like your friends, Nerve.

That's part of the reason why I started howling about this over 4 years ago. If it was evident to a layman like me that something was very wrong, and getting wronger by the day, than it should have been evident to folks like Al "I didn't get it" Greenspan. Hedid get it, he just didn't care, because he figured only the little guy will take it in the shorts, and Greenspan's a libertarian social-Darwinist at heart.

Farken Sock-kickin' Bastard.

|

|

| | | 88 | nerveclinic

ID: 105222

Sat, Sep 22, 2007, 13:15

|

Bili I don't know what you're so traumatized about...this is from CNN Money website.

While California suffers in the housing crisis, the economy of nearby Washington state is flourishing with strong job growth and some of the highest appreciation in home prices in the nation.

The outlook for Washington's economy is bright because so many people are moving there in response to help-wanted advertisements. Seattle, the state's biggest city, is an especially hot job market, boosting confidence of sustained growth.

Microsoft co-founder Paul Allen's Vulcan Inc., for instance, sees few obstacles to turning Seattle's South Lake Union area into a thriving residential neighborhood, given Washington state's economic strength.

Lori Mason Curran, market research manager at Vulcan Real Estate, expects 135,000 people will move into the Seattle market over the next five years, propelling demand for housing that Vulcan's property unit is building in South Lake Union.

Vulcan Real Estate's foray into building office property in the industrial and warehouse area "on spec," or without guarantees of leases, will also pay off because of healthy population and job growth, she predicts.

"Seattle is really, really strong on both fronts," she told Reuters during a telephone interview on Tuesday.

Brisk hiring, especially by manufacturers, builders and software companies, is propelling that growth, said Victor Moore, the state's budget director.

|

|

| | | 89 | biliruben

ID: 4911361723

Sat, Sep 22, 2007, 14:48

|

You assume stock analysts are crooked, yet you listen rapt to spec developer's dreamy forecasts?

Please.

|

|

| | | 90 | Boxman

ID: 571114225

Sun, Sep 23, 2007, 10:00

|

Nerveclinic: I just talked to my friend who works for country wide, been there 5+ years...he's looking at a layoff next week.

2 kids, wife, big mortgage.

What kind of mortgage?

|

|

| | | 91 | nerveclinic

ID: 105222

Sun, Sep 23, 2007, 17:34

|

What kind of mortgage?

ha

country wide of course.

Hi quality but big monthly with loss of income pending the severance which so far, based on the earlier layoffs, have been next to nothing.

|

|

| | | 92 | nerveclinic

ID: 105222

Sun, Sep 23, 2007, 17:38

|

You assume stock analysts are crooked, yet you listen rapt to spec developer's dreamy forecasts?

The overall article wasn't written by a spec developer and most of it was just reporting statistical facts.

Almost every article I read about the housing crisis lists Seattle as one of the few areas spared so far.

|

|

| | | 93 | biliruben

ID: 17502215

Mon, Sep 24, 2007, 12:06

|

Of course things are currently rosy - housing prices haven't yet started to decline here.

As soon as they do, and I think it will be relatively soon, the local economy will be effected substantially.

|

|

| | | 96 | biliruben

ID: 579411512

Wed, Nov 07, 2007, 18:12

|

Nearly 4 years after I expressed amazement and concern over the price of housing in Seattle in post 34 of this thread, prices have finally stopped defying gravity.

I went ahead and bought a house, despite my misgivings, 3 and a half years ago. I'm glad I didn't wait!

Is it irony that Seattle is pretty much the last metro area to succumb to the bursting bubble? I wish Mr. President were around to help me with the definition of irony. I also wish Madman were around to tell me he had it all figured out years ago. ;)

Goes to show you that even if you know what should happen, it's much harder to try and figure out when it will happen.

|

|

| | | 97 | biliruben

ID: 579411512

Wed, Nov 07, 2007, 18:38

|

BTW, there is now an extremely popular Seattle Bubble blog, from which I took the above graph.

Very well run with great contributors, and the bain of (almost) all who make a living from real estate in the Seattle area.

They generally hate it with a white-hot passion, and blame it for destroying their livelihoods. Pretty silly, I know.

|

|

| | | 98 | The Beezer

Dude

ID: 191202817

Wed, Nov 07, 2007, 18:48

|

I'm actually close to the other major metro that hasn't started a price decline according to most measures - Charlotte, NC. I've got to believe that with the financial industry fallout hitting some of the key employers in town (BofA, Wachovia, LendingTree to name just a few that have started layoffs) that it will soon follow the rest of the country. As to the extent, it's difficult to say. There's been an influx from other areas of the country and population is booming there and in other nearby towns, but there's no shortage of land in surrounding areas available for development that is within commuting range.

I need to practice writing more and sharpening my ability to argue effectively (in the best sense), so I plan to post more in the forum here. It's frankly kind of intimidating to post here due to the quality of the minds that work here and how effectively they are able to find the weak spot in a statement and hammer on it, yet it's kind of cheating to only read and never post, eh? I'm not looking to convince anyone that I know it all and am willing to change my mind if I'm convinced by the evidence that it is warranted. Feel free to call me on that down the road. :)

I figured I'd start in an area I've been studying extensively recently. My fiancee and I started seriously looking at housing in late 2006, and my research quickly led me to most of the housing blogs and sites referenced, as well as several others (I have an entire Netvibes tab devoted just to housing news).

It is my feeling that the bubble blogs are mostly correct in the thought that we are set to see historic declines in the housing market. However, I believe the speed of the Internet has fooled many of them to believe that changes will occur rapidly and have led them to overstate their time lines. I think that too many people have a vested interest to let things decline without fighting it with everything they have, so I expect many fits and starts as prices revert to historical norms.

With that said, I think the recent credit market activity is having a significant impact on real estate and exacerbates the trends that are already underway in most locales. I haven't seen a plan for a way out that I consider to have more than a remote chance of working.

Despite being the biggest housing bear by far that I know in person, we ended up buying a house on a 30-year fixed with 20% down in August that fit our criteria (decently far away from other people, within commuting distance for both of us when we get married next year, well within our price range, and structural factors too numerous to mention). We also bought in a rural area and the house we bought has only appreciated slightly over 3% per year over the past 10 years, so I think that any decline to its value is likely to be modest. Since we plan to live there long term, I'm not terribly concerned.

I look forward to the majority of home purchases meeting the criteria that we used in buying our house. It's clear to me that the rapid appreciation of prices has had many ill effects that need correction.

|

|

| | | 99 | Seattle Zen

ID: 49112418

Wed, Nov 07, 2007, 18:58

|

Since we plan to live there long term, I'm not terribly concerned.

Your lack of concern is wise. Every housing market decline can be weathered simply by not moving. The people who are most likely to take nasty hits are those who have to move shortly after they purchased.

Don't limit your bold, new attitude of posting to boring threads like this :) Looking forward to other, well written posts.

|

|

| | | 100 | biliruben

ID: 579411512

Wed, Nov 07, 2007, 19:06

|

I believe the speed of the Internet has fooled many of them to believe that changes will occur rapidly and have led them to overstate their time lines. I think that too many people have a vested interest to let things decline without fighting it with everything they have, so I expect many fits and starts as prices revert to historical norms.

I agree, but I think the a bigger reason for a slow decline is that people don't like to "lose" money, and if they don't have to sell, they won't unless they get the price the imagine their house is worth.

If Jo and Betty down the street got 400K last year for the same house as ours, but we have the granite counter-tops and mature trees, I'm going to scoff when someone offers me 375K.

If you look at LA's last big crash in the early 90's price changes went negative, accounting for inflation, for nearly 6 years before you started seeing appreciation again.

We are in uncharted territory here, however. There has never been a run-up for so long and for so high as we've seen today. Japan took 15 years to correct. My guess is that better statistics and more transparency, partly due to the internet, may cause a quicker and deeper crash now rather than what has been seen in the past, but it's really hard to predict.

My plan is to start shopping for a bigger house around 2010, as the majority of LA's declines happened in the 1st 2-3 years, but I am going to keep my options open and keep my finger as close to the pulse of the market as possible.

It sounds like you will be just fine, Beezer. Even if your house declines in value, as long as you can keep up with the mortgage, it shouldn't have any effect on you, beyond psychological.

How quickly to Charlotte appreciate during the boom years?

Glad to hear you are going to post more. Quality posters with well thought-out ideas are always a welcome addition!

|

|

| | | 101 | The Beezer

Dude

ID: 191202817

Wed, Nov 07, 2007, 20:09

|

Thanks guys. We're set up pretty well finance wise, paying much less than historic guidelines on housing as % of income, and we really love where we bought, so no worries here. I'm not looking to fund my retirement from it, I just want a nice place that I enjoy being.

I looked at the Case-Shiller data I downloaded a few months back and since January 2000, Charlotte prices had cumulatively risen 29.43% as of January 2007. This compares to 179.42% in Miami and 168.68% in LA on the high end, and 17.96% in Detroit and 18.83% in Cleveland (Dallas was the only other metro in the 20 city index below Charlotte). Seattle stood at 83.92% for the same time frame.

Overall, the price appreciation in Charlotte has been much less than other metros, especially when you take population change into account (except for Dallas). The house we bought is actually about an hour outside of there and that area seems to have appreciated even less during that time.

|

|

| | | 102 | sarge33rd

ID: 99331714

Thu, Nov 08, 2007, 10:25

|

You made I think, a wise choice. Being an hr away currently, with a population trending upward, could well mean being 20 minutes away from the outskirts of town in 10 years or less. Once that happens, and it becomes a 20 minute commute vs a 1 hour drive "to town", THAT IMHO, is when you will see the rapid appreciation. (So called "bedroom" towns, always seem to do very well property value wise, once the cities developments spread outward to within 1/2 hr drive or so. (At least, thats what I've seen historically throughout the midwest.)

|

|

| | | 103 | biliruben

ID: 579411512

Thu, Nov 08, 2007, 15:23

|

Cramer's head explodes again.

Calling Cuomo a communist. Sweet. What a clown.

What almost all of this craziness is about about is laying-off risk on some patsy of shell.

- WAMU claims that inflated appraisals aren't their problem. They have a deal with Freddie and Fannie that if the loans they sell to them don't appraise, WAMU has to buy them back at par. WAMU says they laid-off that risk on EappraiseIT (subsidiary of American Home). Cuomo says "not so fast".

- The big investment banks claimed that they had laid off the risk inherent in all the MBSs and CDOs in these shell SIVs. The investor market says "not so fast".

The big lenders had been operating under the assumption that they were laying off risk by letting the subsidiary brokerages write the icky mortgages and selling the nuclear waste to investors. The market is balking.

And all Cramer can do is whine about the party stopping.

Jim, those that make the money in the good times must, MUST, be the ones taking the risk when things turn bad. Otherwise this swell capitalist game breaks-down like we are seeing right now.

The sooner it's cleaned up, the better we will be as a country.

But it's going to hurt. Bad. And a lot of innocent people are going to pay the price. And a lot of those who profited from the game, and going to be sipping their Mohitos in the Antilles.

But we gonna get some of the shysters to by at least some of the damage. The more the better, and Cramer can just suck it.

|

|

| | | 104 | The Beezer

Dude

ID: 191202817

Thu, Nov 08, 2007, 18:28

|

Right on, bili. I wish this stuff would have come to light in '04 or '05 when it would have done more good, yet back then no one cared. So the appraisal was over by $100K? No biggie - the house will probably be legit at that value in a year anyway. As Buffett has said, "It's only when the tide goes out that you learn who's been swimming naked". It's probably going to start looking like a nudist beach out there before it's said and done.

|

|

| | | 105 | Perm Dude

ID: 3101888

Thu, Nov 08, 2007, 18:56

|

Agreed, bili. Bitching at Cuomo because he's not letting the lenders continue to make money: "Cuomo's about losing money."

Classic.

Cuomo must be a communist if he's throwing a wet blanket on banks lending money they shouldn't and shucking off the risk of bad loans onto others. What a whiner.

|

|

| | | 106 | Seattle Zen

ID: 49112418

Fri, Nov 09, 2007, 15:35

|

An hour outside Charlotte? Damn, that's the middle of nowhere!

|

|

| | | 107 | The Beezer

Dude

ID: 191202817

Sat, Nov 10, 2007, 10:47

|

It's definitely quiet right here, SZ. Since I grew up on a farm I don't really have any interest in living in the city. As long as they have high-speed internet, of course. Plus I despise HOAs so housing developments aren't for me either.

I like to use the Charlotte Observer as my barometer for housing around here. Interestingly enough, the front page today is dominated by the writedowns and warnings by Bank of America and Wachovia (both based here),. The business section has a nice story about Beazer Homes (no relation) delaying payments to subcontractors, while the New Home and At Home sections have nothing on their front page about the housing market itself, which is most unusual.

Meanwhile, KB Homes has an ad showing a house marked down from $185,402 to $146,996. That 20% haircut does not sound like a booming market to me. A fair amount of other markdowns on new homes, low 30 year fixed rates being offered by developers, and other incentives dominate nearly every other ad in the real estate sections.

It will be interesting to see how prices hold up here over the traditionally slow months before next spring. Charlotte is set up to have a slow spring similar to what most other locales saw in 2007.

|

|

| | | 108 | Seattle Zen

ID: 529121611

Tue, Nov 13, 2007, 21:31

|

|

|

| | | 109 | Perm Dude

ID: 361055149

Thu, Nov 15, 2007, 15:59

|

Dems plan to make sub-prime lending an issue

Snore. Yeah, I know that it is important, but it is important as policy and regulatory issues, not as a campaign issue. The Dems get the federal government handed to them, and they are just too dumb to figure out what to do about it.

|

|

| | | 110 | biliruben

ID: 579411512

Thu, Nov 15, 2007, 16:59

|

As long as they paint it as a reason why smart regulation and enforcement is both useful and important to keep capital markets humming smoothly, I think it's a terrific campaign issue.

For too long the Republican push to privatize and deregulate has been answered by either deafening silence or worse: the Dem's agreeing.

If the message is:

Regulation is essential and beneficial to capitalism, and

Government is better and performing some tasks than private business,

Then push it and push it hard.

If instead, it's Republicans are responsible for the mortgage mess, it's a non-starter.

|

|

| | | 111 | nerveclinic

ID: 105222

Thu, Nov 15, 2007, 19:14

|

Bili Cramer's head explodes again.

Funny though, he was right the first time his head exploded.

Does anyone still think the Fed shouldn't have cut interest rates?

|

|

| | | 112 | biliruben

ID: 579411512

Thu, Nov 15, 2007, 19:39

|

Let's see where inflation goes.

It didn't solve the liquidity problem, you notice. Just provided a little psychological boost.

|

|

| | | 113 | The Beezer

Dude

ID: 191202817

Thu, Nov 15, 2007, 22:27

|

bili 110

Another bad outcome would be if the Dems start pushing bailout proposals like what Sen. Dodd was pushing early this year. I'm concerned that this is what will end up happening, because heaven forbid there are consequences for people and companies acting like morons.

Nerve, I don't think that rates should have been cut, but I'll admit that I'm no expert. My reasons include the following:

- the commercial paper market is largely frozen (as bili alluded to in 112)

- the dollar has gone down in value versus many other major currencies (which seems close to forcing the unwinding of the Yen carry trade which will not be good for a lot of market participants) and against most commodities

- the market seems to be pricing in continual cuts yet does not seem to benefit for more than a day or two when this occurs (again as bili stated in 112), which resembles giving a rotten brat candy to keep him quiet IMO.

Having said that, I fully expect the Fed to continue to cut because they are terrified of a deflationary environment arising like what Japan has seen since 1990. The one thing the Fed does not want to be is largely irrelevant, and deflation puts them much closer to that than they'd like to be.

What's your perspective on the benefits of the recent cut? I'd like to hear more about that.

|

|

| | |

| | | 115 | Myboyjack

ID: 8216923

Thu, Nov 15, 2007, 22:51

|

You have to admit the $7 a month payment is attractive. I pay more than that for sattelite radio.

|

|

| | | 116 | biliruben

ID: 4911361723

Thu, Nov 15, 2007, 23:43

|

Beezer - I don't think they'll continue to cut, and I think they've intimated as much. I think they were genuinely shocked at watching the dollar's remarkable plummet after the last cut, and are taking seriously China's implied threat to start selling off their dollars.

Cleveland. The next Detroit. (I'd say Buffalo, but I have a fondness.)

|

|

| | | 117 | The Beezer

Dude

ID: 191202817

Fri, Nov 16, 2007, 05:42

|

I would prefer to be wrong about that, bili. The futures market seems to be going back and forth on this as well.

|

|

| | | 118 | nerveclinic

ID: 105222

Fri, Nov 16, 2007, 07:46

|

When asked if the rate cut was a good thing... (I've been for it since before it took place for the record)

Bili Let's see where inflation goes.

So are you making a stand? You've had two months to think about it. Were the rate cuts a good or bad thing. It's easy to wait around and make up your mind 6 months later.

Inflation? What about deflation? People are losing huge amounts of economic value in their homes. Not just sub prime borrowers, but people with good credit who have to sell into this market.

Inflation, maybe the least of our worries. Even so we've had two months for it to take off and so far the numbers look encouraging. Oil is up and food is up (partly because fields are being planted with corn for ethanol.) These were both trends before the cut though.

Other then that the numbers are within the Fed target.

The inflation rate uses rental property instead of home prices. Where would inflation be if the number included home prices....we might be looking at deflationary numbers.

It didn't solve the liquidity problem, you notice. Just provided a little psychological boost.

Didn't solve the problem? Where would we be without the cuts?