| RotoGuru Politics Forum View the Forum Registry XML Get RSS Feed for this thread | Self-edit this thread |

|

| 0 |

Subject: US Currency - The Next Bubble To Burst Posted by: Boldwin - [26451820] Tue, Nov 03, 2009, 05:04 The guru I trust most on economic matters, Nouriel Roubini: NYU economist Nouriel Roubini argued in the newspaper that by keeping federal fund interest rates at zero, Federal Reserve Chairman Ben Bernanke is stimulating a historic stock market rise that is being fueled by money investment managers borrowing from the federal government.Getting sucked in by talk of the recession being over, or nearly over? Don't be. For the umpteenth time I tell you, simplify your lives people. You aint seen nothin' yet. | |||||||

| 73 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 09:52 |

Fun fact:The dollar is a major form of cash currency around the world. The majority of dollar banknotes are estimated to be held outside the US. More than 70% of hundred-dollar notes and nearly 60% of twenty- and fifty-dollar notes are held abroad, while two-thirds of all US banknotes have been in circulation outside the country since 1990Make sure you got that right, bili, cause if they actually can come flooding back... | ||||||

| 74 | biliruben ID: 28420307 Thu, Jul 30, 2015, 09:56 |

Looking at the top 5, I don't see any signs of intelligent life, captain. followthemoney.com peakoil.com zerohedge survivalistboards libcompass Just explain, step by step, how you expect the markets to react to some government doing what you say they will do. Step by step. Action, reaction. Show me you know something besides hysteria. | ||||||

| 75 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 10:18 |

Really? 145,000 returns for "petrodollars flood back home", and heaven forfend the top five believe that's a superbad problem or even that that's possible. That the world economy works that way. Preposterous idea no sane person would consider. Most dollars are held by foreigners who need those dollars to buy oil, etc, but mainly oil. What if the reserve currency becomes the yuan or IMF special drawing rights or who knows, bitcoins? Suddenly those dollars will come back to the USA, buy an asset and stay in the USA from that time forward. Think that would be inflationary much? Think the dollar in your bank account is still worth the same? | ||||||

| 76 | biliruben ID: 28420307 Thu, Jul 30, 2015, 10:26 |

I'm just trying to get the muddle out. So step 1. A country starts to hold Yuan as a reserve currency. Okay. So step 2... | ||||||

| 77 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 10:34 |

Further, banks around the world hold USA treasuries as securities to prove they are legitimate institutions. What happens if they don't think they're all that reassuring? The next time bili goes to the bank to support the extra 100,000 illegal immigrants who showed up this month... ...oops, no one showed up at the auction. Can't borrow anymore. | ||||||

| 78 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 10:34 | Off to breakfast with my dad. Later. | ||||||

| 79 | biliruben ID: 28420307 Thu, Jul 30, 2015, 10:44 |

There are smart folks who think like you do. Doesn't mean they aren't wrong. Besides his job, how much did Bill Gross lose over the last 6 years making bets around just this sort of logic? 5 billion? 10 billion? Probably more. I've made 2 bubble bets in the last 10 years: 1) I sold my house in 2007. 2) I double-shorted gold at $1900/oz. I don't regret either. | ||||||

| 80 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 12:06 |

Could we agree to something civil? Could you please admit that just maybe losing reserve currency status...just maybe...might see petrodollars come flooding back home? Just maybe that's the way the world works after all? Kinda like Kissinger in reverse? | ||||||

| 81 | biliruben ID: 28420307 Thu, Jul 30, 2015, 12:15 |

If you explain how it will work. I just don't see it, or what it even really means. Dollars don't move by themselves. They need to be used in a transaction to purchase a good, and there are 2 parties, a buyer and a seller. Let's start there. What are the current owners of dollars going to buy that will be inflationary? | ||||||

| 82 | biliruben ID: 105572020 Thu, Jul 30, 2015, 14:09 |

Let's put aside the reserve currency question. Let's look at a related idea, and maybw this us what yoi meant. just say that China starts to sell all those us bonds we hold. That might actually serve to weaken the dollar against the yuan. But that would also serve to improve our trade deficit and create more jobs for Americans. That would be a good thing, and likely return to equilibrium fairly quickly. I can't see how this would lead to hyper inflation. | ||||||

| 83 | biliruben ID: 561162511 Thu, Jul 30, 2015, 14:12 |

..they hold. Hard to argue on a tiny, American made phone. | ||||||

| 84 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 19:51 |

I gotta do this later. There are two related issues here. How this country goes about financing the deficit related to the country's perceived soundness. And inflation. The desirability of treasuries relates to the first. A wild rise in monetary supply [flooding back home] leads to a wild rise in the price of something, whether it is stocks or RE/hard assets or food, etc. Likely everything. You can divert the conversation into why QE hasn't already done that, and that would be interesting...but eventually the fundamental chickens come home to roost. | ||||||

| 85 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 20:48 |

Basic transaction: 1) Greek oil buyer used to maintain a balance of US dollars because they would need them for oil imports. 2) Greek oil buyer buys something else with those dollars instead and starts holding yuan or renminbi or something else... 3) Whether those exchanged dollars go directly back to the USA immediately or not, they never again get held for oil purchases by that Greek oil buyer. Eventually the dollars end up back in the USA and as the demand for dollars has gone down they are likely to stay in the USA. 4) Bubbles and inflation at home are the result. | ||||||

| 86 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 20:52 |

Equilibrium...yeah, that's not the panacea. But it is what we are headed for. Our wages are indeed surely being averaged with the rest of the 'living-on-$100-per-year' world. Kumbaya | ||||||

| 87 | Boldwin ID: 49572022 Thu, Jul 30, 2015, 20:58 |

Average Chinese family income is 1/8 it's American counterpart. May all those people who pushed the WTO see their incomes end up at the new normal. May they have to compete with slave labor for their next meal. | ||||||

| 88 | biliruben ID: 28420307 Fri, Jul 31, 2015, 01:04 |

Well, yeah. There is an ongoing competition for jobs, at all levels of the economic ladder. F'in capitalism and market forces are not the friend of the US worker. Not sure what this has to do with reserve currencies however. | ||||||

| 89 | Boldwin ID: 49572022 Fri, Jul 31, 2015, 03:58 | Capitalism didn't bring us down. Big government micro-managers, the exact opposite did. Treasonous treaties and trade deals did. Uber-wealthy Internationalists who wanted to bring America down did. Cultural marxists who hated all things American did. | ||||||

| 90 | Boldwin ID: 49572022 Fri, Jul 31, 2015, 04:00 | Everyone with an anti-American agenda had discipline and persistence. The average voter didn't. | ||||||

| 91 | biliruben ID: 81382416 Fri, Jul 31, 2015, 10:52 |

The protectionism, distorting pure market forces, is marxism? And George Bush committed treason? Just trying to follow your, um, logic. | ||||||

| 92 | biliruben ID: 105572020 Fri, Jul 31, 2015, 13:18 | Actually you are suggesting removing the protectionism is Marxism. That just silly. | ||||||

| 93 | Boldwin ID: 49572022 Fri, Jul 31, 2015, 16:49 | 'Competing' with slave wages held down artificially by a marxist government does not constitute free markets. It is also impossible. That trade war is over before it starts. As your closed factories demonstrate. | ||||||

| 94 | Boldwin ID: 49572022 Wed, Aug 12, 2015, 02:34 | China situation different than reaction in previous situations. | ||||||

| 95 | Boldwin ID: 2711516 Mon, Aug 17, 2015, 17:28 |

Interesting:

| ||||||

| 96 | Boldwin ID: 2711516 Tue, Aug 18, 2015, 20:26 |

While I read a zillion people expecting a crash soon and that China will be the ignition point, the reporter I trust most claims China has turned the corner and nothing to worry about. I wanna believe the crash will be delayed and that I have a year at least to prepare. Please have it right Ambrose. | ||||||

| 97 | biliruben ID: 137281811 Wed, Aug 19, 2015, 11:27 | What people? What sort of crash? Why? | ||||||

| 98 | Boldwin ID: 2711516 Wed, Aug 19, 2015, 20:02 |

It's a house of cards and you haven't even caught a whiff of it, have you? Virtually every country is operating on unprecedented levels of quantitative easing to paper over economies and deficit spending out of control. Not a central bank lever left in sight that works anymore. EU on the brink. Japan on the brink. Russia in panic mode and openly sabre rattling. China with their banking system and stock market melting down. USA so bankrupt it's very nearly mathematically impossible to recover. All the while taking on new creative entitlement burdens. Vultures like Soros and hedge fund managers strip mining the wealth of America thru tried and true methods perfected in the Great Recession. Unsupportable derivative overhangs greater than the combined wealth of the world many times over. Companies relocating their headquarters in tax havens and making sure their profits never touch our shores. Our military being hollowed out right before World War. Power abhors a vacuum. America's enemies explicitly spelling out their plan to take us down as our own administration busses in muslim cutthroats from the most Islamist America hating impossible to assimilate countries in the world, like Somalia. Really the only thing holding back the deluge is that the elites haven't finished sucking us dry. The era of the functional nation state [and even functional regional union] is over and they are very very impatient to administer the death stroke and usher in their 'utopian' world government. | ||||||

| 99 | Boldwin ID: 2711516 Wed, Aug 19, 2015, 20:15 |

What's even more ghastly, 30% of America is actually ready to vote for a card carrying marxist so far to the left he can't stomach joining the Dem party. They don't give a crap about western culture, surreptitiously side with the enemy every time. Join hitlerian anti-semetic BDS movements. Think this picture is funny:  Walk Berkley wishing ISIS flag-wavers good luck. And those are the people who are going to be in our foxhole during WWIII. The ones who think Iran, the nukes we just guaranteed them, and the Russian warships now sitting in their harbors... ...should be trusted. ...and that American patriots are the real threat. | ||||||

| 100 | Bean ID: 14147911 Wed, Aug 19, 2015, 22:25 |

The amazing thing is that the only thing at risk in our economy is the currency. It is the illusion that holds everything together. When you no longer believe the illusion, then the economy falters. The chicken littles are the guys who have awaken from the dream. Whose illusion is best.....America for now. Pay no attention to the man behind the curtain. | ||||||

| 101 | Boldwin ID: 2711516 Mon, Aug 24, 2015, 16:51 |

bili That crash. Anyone wanna guess the bottom? Anyone brave enuff to bargain hunt? | ||||||

| 102 | biliruben ID: 28420307 Mon, Aug 24, 2015, 18:23 | A long overdue correction. I'm starting to window shop, but I'll probably wait a bit. | ||||||

| 103 | Boldwin ID: 2711516 Mon, Aug 24, 2015, 21:33 | Bet those connected hedge fund managers and insiders were so short on stocks at the start of this run that they were dancing with atoms. | ||||||

| 104 | Boldwin ID: 2711516 Tue, Aug 25, 2015, 18:28 |

"This is 2008 stuff" - Zerohedge . | ||||||

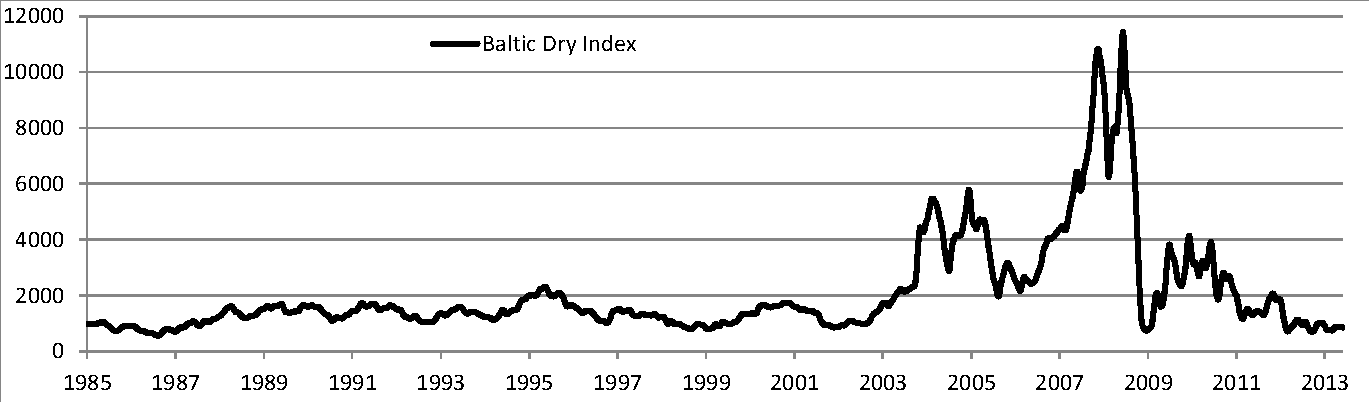

| 105 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 17:10 | The best predictive indicator there is, the Baltic Dry Index is in freefall. | ||||||

| 106 | biliruben ID: 39256112 Wed, Aug 26, 2015, 17:30 |

The supply of cargo ships is generally both tight and inelasticóit takes two years to build a new ship, and the cost of laying up a ship is too high to take out of trade for short intervals,[6] the way you might park a car safely over the winter. So, marginal increases in demand can push the index higher quickly, and marginal demand decreases can cause the index to fall rapidly. e.g. "if you have 100 ships competing for 99 cargoes, rates go down, whereas if you've 99 ships competing for 100 cargoes, rates go up. In other words, small fleet changes and logistical matters can crash rates. - Wikipedia | ||||||

| 107 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 17:31 |

Legendary gold expert Jim Sinclair says what is going on right now in the stock market is just the warm-up act. Sinclair contends, ďThis is a pre-crash, and we are not making it through September without the real thing. Everybody is on credit. Main Street is on credit. This seems to be a bubble of historical proportion when it comes to the amount of money supporting the accepted lifestyles as being the new normal. Raising interest rates is impossible today. The market is so fragile. Nothing can come out that causes people any concern or derivatives any change, nothing whatsoever. We are going through a period of time where expecting nothing meaningful is a dream. These are times never experienced in financial history. . . .It is very possible that we are going to have a super civilization change. Ē | ||||||

| 108 | biliruben ID: 39256112 Wed, Aug 26, 2015, 17:33 | If you believe that, it sounds like you should take out some credit and short the living shit out of the market. | ||||||

| 109 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 17:48 |

Over time, the BDI is the best indicator of global economic health because, unlike the futures market, the BDI does not engage in speculation as it provide near real time data on what and what is being shipped. The determinations made by the BDI are such an accurate indicator of economic activity because businesses donít book freighters when they have no cargo to move. In short, the BDI is the worldís financial blood pressure measure. The BDI is said to be one day away from reaching its all-time low. - The Common Sense Show David Hodges | ||||||

| 110 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 17:49 | That's what the hedge funds are doing. | ||||||

| 111 | biliruben ID: 39256112 Wed, Aug 26, 2015, 17:57 |

The chart sure looks like a trailing indicator. If you were buying on credit at it's all-time high in mid-2008... Yikes. And selling in 2009 when the market was poised to double inside of the next 2 years. I'll skip the market-timing and cryptic rants from zero-hedge, thank you very much. That way leads to the fleecing of the sheep. | ||||||

| 112 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 18:05 | That's what I did in 2008. | ||||||

| 113 | biliruben ID: 39256112 Wed, Aug 26, 2015, 18:10 |

You bought a mega yacht? Cheated on your wife? You're more cryptic than zero hedge. | ||||||

| 114 | biliruben ID: 39256112 Wed, Aug 26, 2015, 18:13 |

Hedge funds are for suckers. Unless you are running them. If you win, you win. If you lose, you win. If you give them your money, you sooner or later you lose. Ask all the pension fund managers who are telling them to take a hike. | ||||||

| 115 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 18:22 | I was speaking in my Elena Ambrosiadou voice. | ||||||

| 116 | biliruben ID: 39256112 Wed, Aug 26, 2015, 18:27 |

She somehow misused the BDI in 2008 to convince herself to sell instead of buy? Your feminine side isn't too bright, but perhaps lucky is better than smart. | ||||||

| 117 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 18:44 |

Like all the hedge funds that made out like bandits, they were fully in position shorting the markets before the crash. Another hedge fund is an interesting example. Steven Eisman convinced Obama to crush small independent colleges, by denying their students government subsidies...and then of course Eisman who previously became rich shorting the housing bubble, began shorting small private education. The wealth being created today in America is largely connected cronys and insiders surfing America's decline as she circles the toilet bowl. And as they deliberately sabotage it. | ||||||

| 118 | biliruben ID: 39256112 Wed, Aug 26, 2015, 18:48 |

That's what "hedge" means. Of course most did well before that crash. If you really think they were able to predict the market because of some sort of insider info or some market indicator, than they are much stupider than I thought. We should all be owned by them right now, if that were the case. Look at your latest heartthrob Elena's record lately by the way. It's pathetic since she tossed her quant husband overboard. | ||||||

| 119 | biliruben ID: 39256112 Wed, Aug 26, 2015, 18:50 |

Did well during the crash I mean. If they used BDI they wouldn't have, however. You seem adept at one thing, and that thing is changing the subject. | ||||||

| 120 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 19:01 | She also threw out her entire research team in a fit of paranoid pique over who was supporting which side of the couple. | ||||||

| 121 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 19:10 |

Had you reacted to the BDI when it went into freefall June-July 2008, by shorting housing, investment banking, etc...you would have made out like bandits after Sept when Lehman was allowed to go bankrupt and Goldman/Sachs and Morgan Stanley weren't. | ||||||

| 122 | Boldwin ID: 2711516 Wed, Aug 26, 2015, 19:13 | I'll also point out that the BDI had a false drop in Feb of this year. The central banks barely averted disaster. But as you see from the 2008 BDI, one save doesn't win the soccer match. | ||||||

| If you believe a recent post violates the policy on Civility and Respect, you may report the abuse via email to moderators@rotoguru1.com | ||||||||

| ||||||||

Post a reply to this message: US Currency - The Next Bubble To Burst | ||||||||